How To Properly Void A Check In Quickbooks

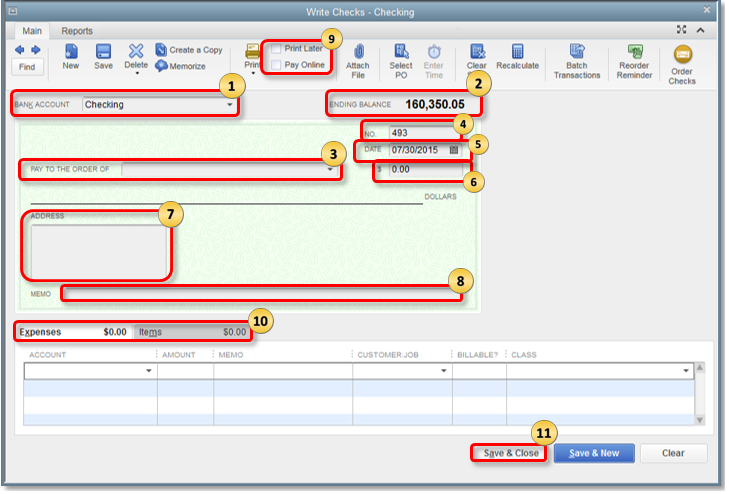

To void a check first open the check to void and display it in the Write Checks window. Do not void the check.

How To Void A Check In Quickbooks Youtube

How To Void A Check In Quickbooks Youtube

First get a blue or black pen.

How to properly void a check in quickbooks. Select Accounting from the left menu. Open the check in the Write Checks window. Double click on the entry to view the check.

Note that VOID has been inserted in the Memo field. When the check hasnt been cashed and wasnt included in your previous reconciliation you can void it by following the steps below. Then select Edit Void Check from the Menu Bar to void the check shown in the Write Checks window.

Choose the account that was used to write the original check. Select Accounts Payable to open the check ledger or register. Also discussed how to undo void or delete check in quickbooks.

Find the check to be voided either in the register or on a QuickBooks report. Select the check to void from the Expense Transactions list to open it in the Check screen. Click Expenses and select your Clearing Account from the list of options.

Select Chart of Accounts at the top. That IS the reversing entry not in the Background but in the File. TOOLS IN QUICKBOOKS DESKTOP.

Make a note within the memo that you voided the check and re-issued the check noting the current period date and new check number by way of a journal entry. Write VOID across the payee line. Choose either Delete Check or Void.

QuickBooks will void the check and enter the appropriate journal entries. The checks variety receiver and date likewise in such cases youll use quickbooks to void a check before settling the trade. If try this in a closed period you will get this pop-up message.

Inside of QuickBooks Desktop when you use the Void feature by finding the check and clicking Edit Void Check it changes the amount to zero this is fine if its in the current period. From the menu select Edit Void Check. Changes the original amount of the check to 000 adds the text void.

Properly voiding checks in quickbooks online keeps your bookkeeping records accurate. In the memo field make a note that the check is being voided with a deposit entry as of a current date. Next write VOID in large letters across the front of the check or write VOID in smaller letters on the date line payee line amount line and signature line.

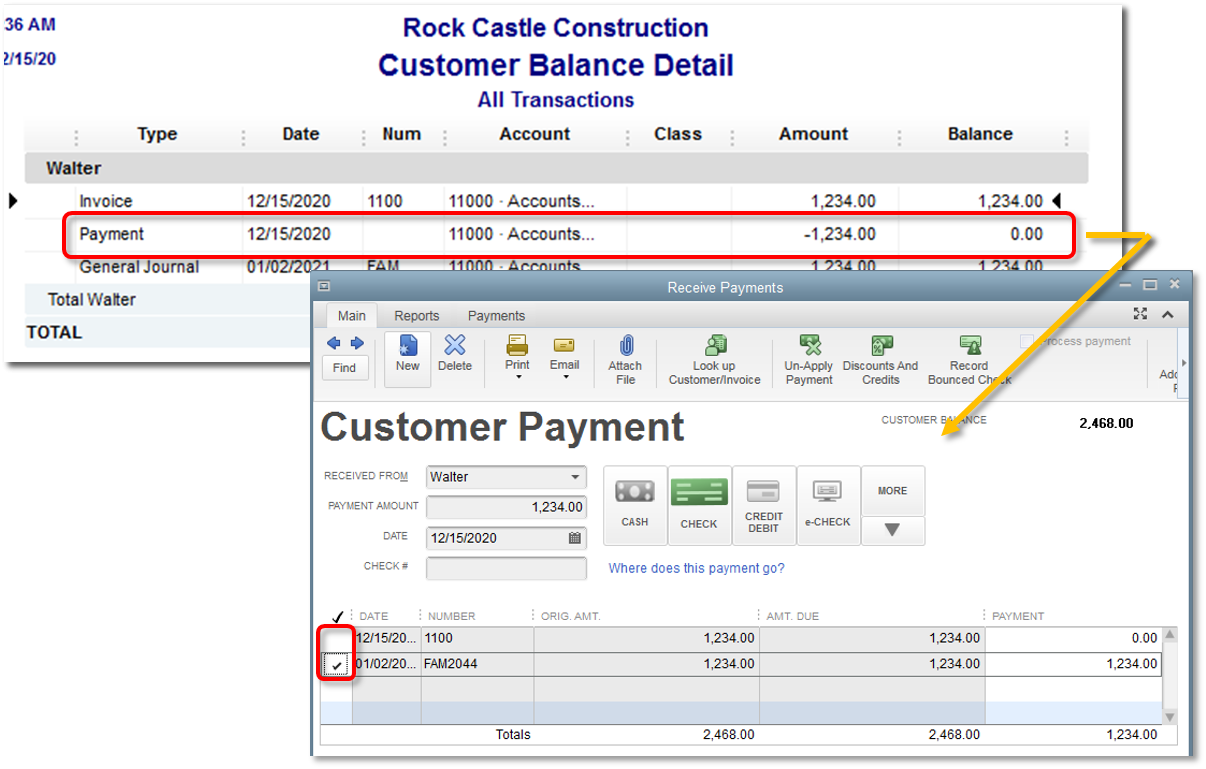

QuickBooks clients often need to void checks that were written in a prior period. How to void a check from a prior period. When prompted select Yes to confirm you want to void the check.

Click on the Lists menu and choose Chart of Accounts. In the Type field select Check. The payee line is where you would normally put who you are writing the check to.

Open the Bill Payment. The usual option is Void Check under the Edit menu. Cancelling and voiding checks in quickbooks online.

Heres how to void a check from a prior period correctly. Quickbooks check marked as void. Void a check without opening the transaction.

Select the bank account the check you need to void was recorded under and choose View. Voiding a check you still have is not complicated. Type any additional details about the transaction in the Memo field.

In this case you can select the Yes Recommended. Find the specific check that you want to void and click on it. Typically this will affect expense and bank accounts.

Select the date range in which the check was received and select Apply. Write void across the check in a number of places to signify to anyone reading that the check is void. Find the check in the register that needs to be voided.

This involves logging in to your account and choosing Accounting Chart of Accounts View Register for the bank account associated with the voided check highlight the check Edit More Void. Select More and select Void from the pop-up menu. You choose to make the Offsetting entry so that you control the date.

Choose Save Close. Its just the Opposite process. Take note of which accounts are being affected.

How do I void a check from a closed period that has exp and liability on it and reissue it in the current period. Go to Banking at the top menu bar then select Write Checks. However this takes the original transaction and changes the amount to 0.

Voided check means that you cancel out the original transaction but the record of the check remains in your quickbooks online account. However prior period income and expenses should not be changed for various reasons such as tax returns having been prepared. If you want to void a check that has already been recorded youll need to take a different approach.

Enter the information for the check including the payee check number date and check total. You can void a check in QuickBooks Desktop Pro that you have created if necessary. Click the Delete drop-down list.

Let you choose the void date then make the reverse entry in the background. The first step is the same as above. Details can be found here.

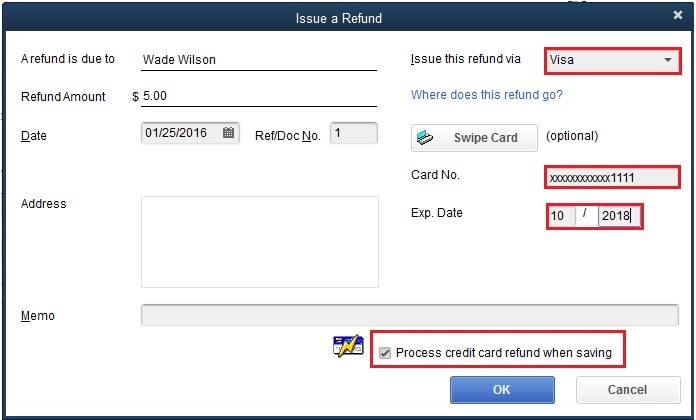

Void Or Refund Customer Payments In Quickbooks Des

Void Or Refund Customer Payments In Quickbooks Des

Void A Check In Quickbooks Desktop Pro Instructions And Video Lesson

Void A Check In Quickbooks Desktop Pro Instructions And Video Lesson

Voiding A Check In A Written Period How To Void A Check In Quickbooks

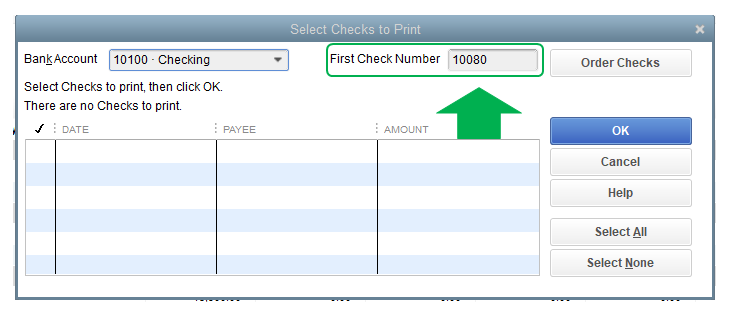

Create Modify And Print Checks

Create Modify And Print Checks

Quicktips Voiding Checks From Prior Periods By Quickbooks Made Easy Youtube

Quicktips Voiding Checks From Prior Periods By Quickbooks Made Easy Youtube

How To Delete And Void Checks In Quickbooks Webucator

How To Delete And Void Checks In Quickbooks Webucator

How To Void A Check In Quickbooks Experts In Quickbooks Consulting Quickbooks Training By Accountants

How To Void A Check In Quickbooks Experts In Quickbooks Consulting Quickbooks Training By Accountants

Cancel A Direct Deposit Pay Check

How Do I Remove A Duplicated Invoice That Hasn T Been Sent Yet

Handle Non Sufficient Funds Nsf Or Bounced Check

Handle Non Sufficient Funds Nsf Or Bounced Check

Post a Comment for "How To Properly Void A Check In Quickbooks"