How Do I Open A Backdoor Roth Ira

Once you have money invested into your traditional IRA the next. How to Create a Backdoor Roth IRA Step 1.

The Optometrist S Guide To Roth Ira Chapter 1 Introduction And Backdoor Roth Ira Ods On Finance

The Optometrist S Guide To Roth Ira Chapter 1 Introduction And Backdoor Roth Ira Ods On Finance

After logging in I point to My Accounts - Balance holdings.

How do i open a backdoor roth ira. But you dont have to handle the process on your own. Unlike a Roth IRA there are no income restrictions for a traditional IRA. Open and Fund a Traditional IRA Start by opening a new traditional IRA.

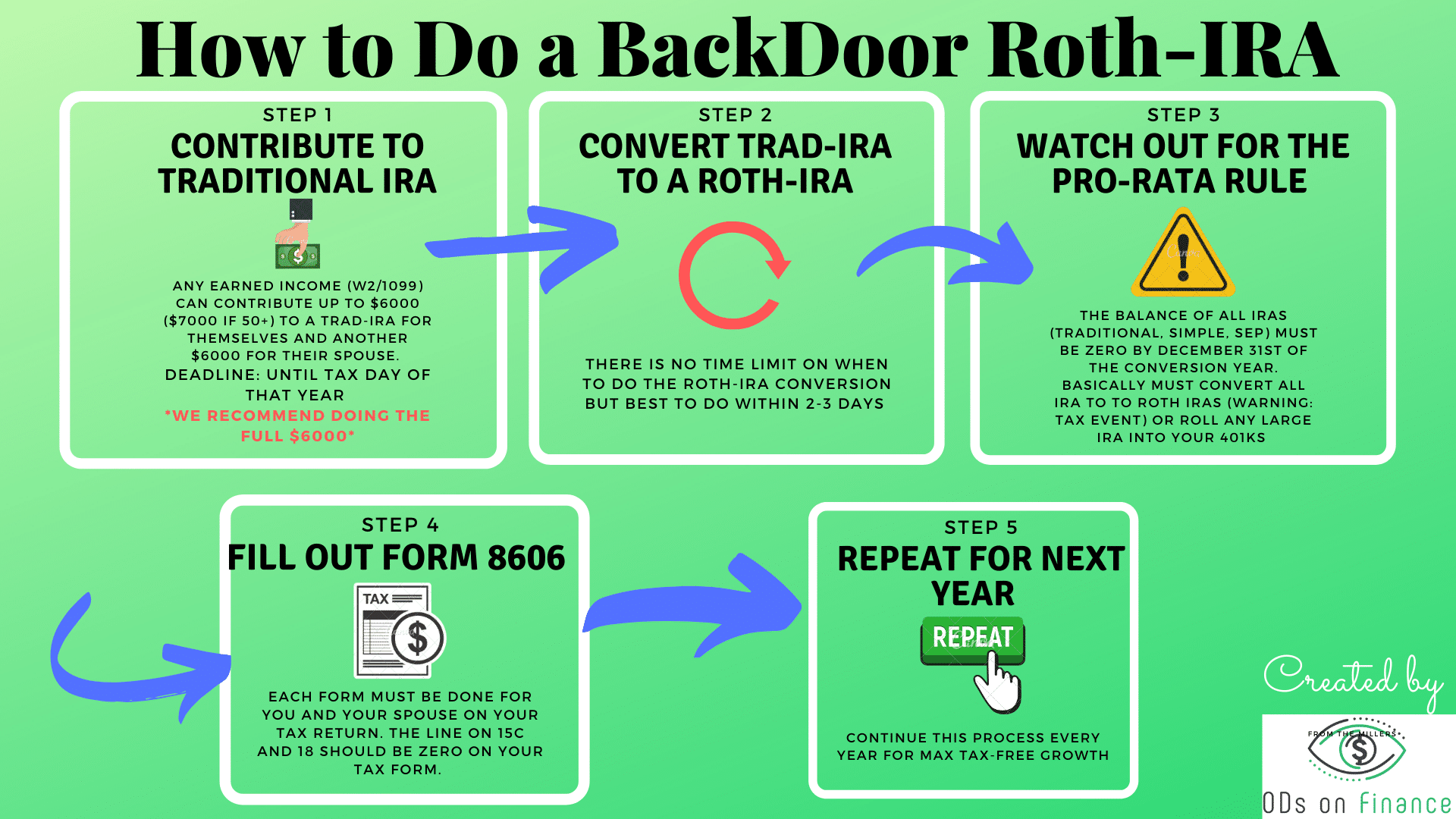

It would be wise to open these at the same place and to have your custodian or account manager help you with the process. Heres a step-by-step guide on how to make a backdoor Roth IRA conversion. After doing the Backdoor Roth you need to file IRS Form 8606 for your taxes for each Backdoor Roth.

Next you can buy any of the asset classes. You can use an existing traditional IRA or open a new account specifically for the conversion. The IRA contribution limit for 2021 is 6000 per person or 7000 if the account owner is 50 or older.

Do you have an IRA account. Therefore you shouldnt ask your IRA custodian or trustee for a backdoor Roth IRA contribution. Theres no minimum self-employed income required to open an Individual 401 k.

How to do a Backdoor Roth IRA 1. Pay the taxes. Immediately Convert Your Traditional IRA to a Roth IRA Why do you want to do this step immediately.

If no you should start by opening one. So if you want to open an account this year and then. A backdoor Roth IRA is not an actual account You should know that a backdoor Roth IRA is not an actual account you open.

If you already have a traditional IRA. A successful backdoor Roth IRA contribution has three steps. A backdoor Roth IRA is not an official type of retirement account but a way for high-income taxpayers to fund a Roth IRA despite exceeding traditional income limits.

There are plenty of great ones out there with fantastic customer service and fiduciaries ready to guide and answer any questions you might have about your investments. 3 It is usually easiest but not necessary to use the. Open a Roth IRA account.

Closely follow these three steps. A backdoor Roth IRA is. Find your Traditional IRA brokerage account and click the arrow to the right of Buy and Sell and select Buy Vanguard funds.

You might already have an account or you might need to open one and fund it. Convert the non-deductible contribution to a new or existing Roth IRA. Once youve converted from traditional to Roth assets youd be able to enjoy the tax-free withdrawal status of that account.

If you dont have one you. Make a Non-Deductible IRA Contribution. Go do some surveys online get yourself an Employer Identification Number free and takes 2 minutes online open an Individual 401 k roll the tax-deferred IRA in there and get on with your Backdoor Roth IRA.

All you did was contribute to a Traditional IRA then convert it to a Roth the next day. If you are yet to open a Roth account you should ensure you open a standard one. If your bank doesnt offer Roth IRA accounts you can open one with a brokerage firm.

Here are the steps to do a Backdoor Roth IRA. Invest into a traditional IRA. Open a Traditional IRA account.

Brokerage Account Backdoor Roth Step 1. What is the Backdoor Roth IRA. Open a traditional IRA with your IRA custodian of choice.

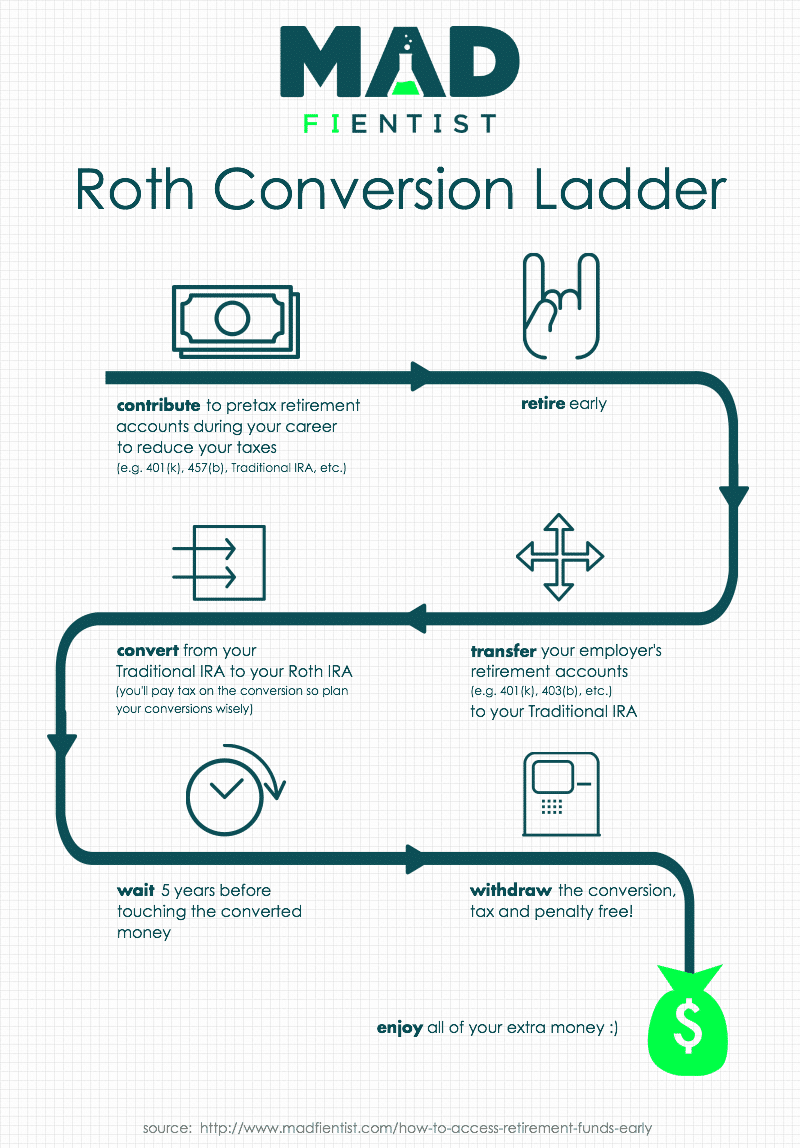

How a Backdoor Roth IRA Works A backdoor Roth IRA involves converting traditional IRA contributions to a Roth IRA. To use the backdoor Roth IRA strategy youll need to take the following steps. Most large firms also offer online access to start the account application.

I wrote a post here discussing the different asset classes. Backdoor Roth IRA contribution limit. Convert the traditional IRA into a Roth IRA.

Make a non-deductible IRA contribution to a traditional IRA. The last step you have to do is fill out IRS form 8606. Put money in a traditional IRA account.

If you want to open up a Roth IRA or traditional IRA youll need to open a brokerage account. First you will deposit money a maximum of 6000 in 2020 and 2021 to a traditional or non-deductible IRA. Contribute to a Traditional IRA For 2021 you can contribute the lesser of your earned income or 6000.

Understand How a Roth IRA Conversion Works Check with your IRA providers about the required paperwork for a Roth. Opening a Roth IRA can be as simple as visiting your banks website and filling out an online application. How to Create a Backdoor Roth IRA Step 1.

The backdoor Roth IRA contribution is a strategy and not a product or a type of IRA contribution. That includes your spouse if they file one too. To complete a backdoor conversion though you will need both a traditional IRA and a Roth IRA.

A backdoor Roth IRA is who you make too much money and still want to contribute to a Roth IRA through the back doo.

How To Set Up A Backdoor Roth Ira At Vanguard Youtube

How To Set Up A Backdoor Roth Ira At Vanguard Youtube

How To Open A Backdoor Roth Ira

How To Open A Backdoor Roth Ira

Backdoor Roth A Complete How To

Backdoor Roth A Complete How To

How Do Backdoor Roth Ira S Work

How Do Backdoor Roth Ira S Work

The Backdoor Roth Tutorial With Fidelity

The Backdoor Roth Tutorial With Fidelity

Backdoor Roth Ira Ultimate Fidelity Step By Step Guide Fatroth

Roth Ira Contribution Limits And Using The Backdoor Conversion

Roth Ira Contribution Limits And Using The Backdoor Conversion

Backdoor Roth Ira Ultimate Guide And Tutorial

Backdoor Roth Ira Ultimate Guide And Tutorial

How A Back Door Roth Ira Works

Why Most Pharmacists Should Do A Backdoor Roth Ira

Why Most Pharmacists Should Do A Backdoor Roth Ira

The Roth Ira Optimize Your Retirement Savings By Knowing The Rules

The Roth Ira Optimize Your Retirement Savings By Knowing The Rules

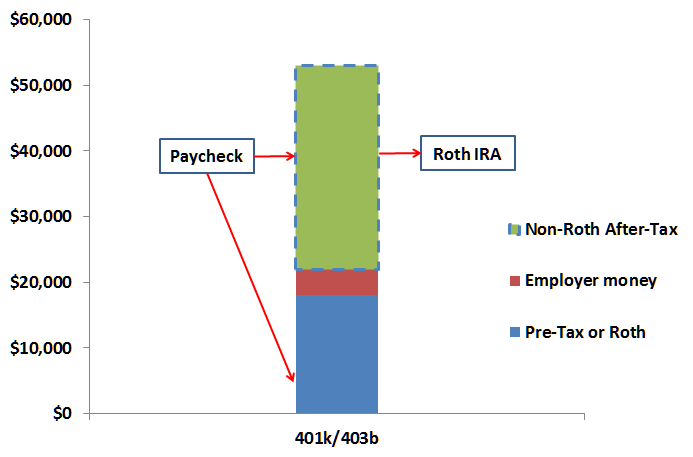

Mega Backdoor Roth Convert Within Plan Or Out To Roth Ira

Mega Backdoor Roth Convert Within Plan Or Out To Roth Ira

Understanding The Mega Backdoor Roth Ira

Understanding The Mega Backdoor Roth Ira

How To Do A Backdoor Roth Ira Zack S Random Thoughts

How To Do A Backdoor Roth Ira Zack S Random Thoughts

Backdoor Roth Ira Ultimate Guide And Tutorial

Backdoor Roth Ira Ultimate Guide And Tutorial

Opening The Back Door To Tax Free Earnings Granite Harbor

Can I Make A Backdoor Roth Ira Contribution Cornerstone Financial

Can I Make A Backdoor Roth Ira Contribution Cornerstone Financial

How To Do Backdoor Roth Ira Roth Ira Roth Ira Contributions Finance

How To Do Backdoor Roth Ira Roth Ira Roth Ira Contributions Finance

Post a Comment for "How Do I Open A Backdoor Roth Ira"