Does Navy Federal Have A Good Roth Ira

SEP Simplified Employee Pension IRA. In the private sector people participate in Individual Retirement Accounts IRAs which have an age requirement that you reach 59 12 before you can withdrawal your monies from an IRA without penalty.

Typically when you open a credit union Roth IRA you can put your money in a fixed-interest account or in a certificate of deposit.

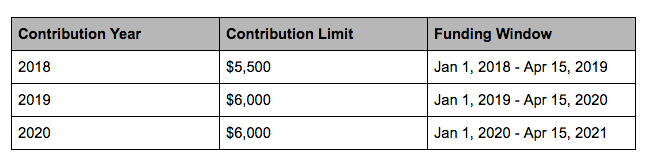

Does navy federal have a good roth ira. This is a choice that federal government employees and US. Cancel Proceed to You are leaving a Navy Federal domain to go to. Heres a chart of the 2019 Roth income limits.

The Navy Federal Credit Union. Navy Federal does not provide and is not responsible for the product service overall website content security or privacy policies on any external third-party sites. Cancel Proceed to You are leaving a Navy Federal domain to go to.

This account has no fees and no early withdrawal penalty from the credit union. The Pre-Tax and After-Tax accounts have different rules as to when you can access those funds. Military professionals need to make when they consider choosing a retirement savings plan.

Its a good fit for anyone looking for a brand known for providing a good customer service experience and offering a branch network. For example you can open a Bank of America Roth IRA. Navy Federal Credit Union NFCU offers many financial products such as its Traditional IRA which can provide several advantages over those products offered by competing financial institutions.

Navy Federal does not provide and is not responsible for the product service. With a Roth IRA the ability to open and contribute to an account is income-restricted. Shop around for the Roth features you desire.

Another way to circumvent the RMD is to convert your tax-deferred accounts into a Roth IRA. While there are certainly some good reasons to use a. If you can meet your essential needs today start saving and take care of your future self too.

The Navy Federal Credit Union privacy and security policies do not apply to the linked site. Explore your retirement savings options to build the retirement you want. Best Roth IRA accounts.

A conversion may not make sense if. Read up on expense ratios before putting any money into any type of IRA account and ensure you understand the cost of investing in certain funds because of their expense ratios. Its never too early to start.

Navy Federal Credit Union offers more information on retirement accounts like savings rate comparisons simple explanations on consolidating if you have more than one IRA and more. Youre likely to need the money within five years. Once the 50 required minimum balance has been deposited to the IRA Navy Federal will credit the bonus directly into the new IRA account within 45 days.

A Roth IRA is an IRA that except as explained below is subject to the rules that apply to a traditional IRA. Its always a good idea to consult a tax or. Navy Federal members have.

If you open up a Roth IRA utilize Vanguard vice Navy Federal or USAA. You cannot deduct contributions to a Roth IRA. Whoever inherits your Roth IRA wont have to pay federal income tax on the withdrawals as long as the Roth IRA account has been open five or more years.

A Roth IRA is a good choice if you want to pass money on to children grandchildren or other heirs because you can share more of your wealth with them since they can withdraw it tax-free. Members who open their first IRA plan on 1102021 and fund their 50 minimum on 2152021 will receive the 50 bonus in their IRA account by 3302021. Open Now a Roth IRA account.

Figuring out where to open your Roth can get complicated partly because some banks also have investment advisories. Also if you are active duty sign up for the Thrift Savings Plan if you have not already. Navy Federal does not provide and is not responsible for the product service overall website content security or privacy policies on any external third-party sites.

The real question is. While the benefits of membership in NFCU are significant it is important to note that membership in Navy Federal Credit Union is not open to everyone. If you satisfy the requirements qualified distributions are tax-free.

If its been open for a shorter period theyll owe tax but no penalty. Choosing a Roth IRA provider. Cancel Proceed to You are leaving a Navy Federal domain to go to.

The TSP for Federal Employees is different. Youll still have to pay taxes on pre-tax contributions and earnings and if youre over age 72 you must first take your minimum distribution and pay taxes on it before the conversion can take place. With Navy Federal Credit Unions IRA Savings account you can get the tax benefits associated with investing in a Roth SEP or Traditional IRA without all the stock market risk.

Can I Transfer My Roth Ira To My Roth Tsp Military Guide

Can I Transfer My Roth Ira To My Roth Tsp Military Guide

3 Reasons Military Members Should Open Roth Iras The Military Wallet

3 Reasons Military Members Should Open Roth Iras The Military Wallet

Roth Ira Vs 401 K Should You Have Both In 2020 Saving For Retirement Retirement Retirement Savings Plan

Roth Ira Vs 401 K Should You Have Both In 2020 Saving For Retirement Retirement Retirement Savings Plan

5 Reasons To Skip The Roth Ira The Smarter Investor Us News

5 Reasons To Skip The Roth Ira The Smarter Investor Us News

Best Roth Ira Accounts In 2020 Cash Money Life

Best Roth Ira Accounts In 2020 Cash Money Life

How To Do Backdoor Roth Ira Roth Ira Roth Ira Contributions Finance

How To Do Backdoor Roth Ira Roth Ira Roth Ira Contributions Finance

Backdoor Roth Ira Steps Roth Ira Ira Rollover Ira

Backdoor Roth Ira Steps Roth Ira Ira Rollover Ira

How Why To Open A Roth Ira For Your Kids Above The Canopy

How Why To Open A Roth Ira For Your Kids Above The Canopy

The Tax Trick That Could Get An Extra 56 000 Into Your Roth Ira Every Year Myra Personal Finance For Immigrants

The Tax Trick That Could Get An Extra 56 000 Into Your Roth Ira Every Year Myra Personal Finance For Immigrants

Primerica Roth Ira Review 2021

Primerica Roth Ira Review 2021

Best Places To Open A Roth Ira In 2021

Best Places To Open A Roth Ira In 2021

Roth Ira Contribution Cheat Sheet Infographic Inside Your Ira Roth Ira Contributions Roth Ira Ira

Roth Ira Contribution Cheat Sheet Infographic Inside Your Ira Roth Ira Contributions Roth Ira Ira

What Is A Roth Ira And Do You Really Need One Adopting A Lifestyle In 2020 Roth Ira Ira Roth

What Is A Roth Ira And Do You Really Need One Adopting A Lifestyle In 2020 Roth Ira Ira Roth

How To Setup An Automatic Roth Ira

How To Setup An Automatic Roth Ira

Should You Put Your Money Into A Roth Ira Or A Roth Tsp Military Com

Should You Put Your Money Into A Roth Ira Or A Roth Tsp Military Com

Fireside Finances Opening A Roth Ira As A Cadet

Fireside Finances Opening A Roth Ira As A Cadet

Webull Ira Account Fees Roth Ira Rates 2021

Webull Ira Account Fees Roth Ira Rates 2021

Usaa Ira Fees Rates Review Roth Traditional Ira Account 2021

Usaa Ira Fees Rates Review Roth Traditional Ira Account 2021

Post a Comment for "Does Navy Federal Have A Good Roth Ira"