How To Open Roth Ira For Child Vanguard

Thankfully you as their parent can open a Custodial Roth IRA on their behalf. In addition to Vanguard you can open a Roth IRA with another online broker a robo-advisor or a bank.

Backdoor Roth Ira Ultimate Guide And Tutorial

Backdoor Roth Ira Ultimate Guide And Tutorial

However not all brokerages offer Custodial IRA accounts.

How to open roth ira for child vanguard. Here are five things to know before you start helping your kid save for their retirement. The contribution limit is 6000 for 2020 or 100 of earned income whichever is less. The Takeaway The process is very simple for setting up a Roth IRA with Vanguard for teens but it will require you calling the company to set it up and having a minimum 1000 to invest.

IRA contributions cannot exceed a minors earnings eg if a minor earns 1000 then only 1000 can be contributed to the account. For 2020 and 2021 workers can contribute up to 6000 a year to a Roth IRA 7000 for those 50 or older. Brokers An online broker lets you choose your own investments.

Youd have to call them at 800-551-8631 during normal business hours. One way to do that is to establish a custodial account Roth IRA or what is known at Fidelity as a Roth IRA for Kids and more generally as a Roth IRA for minors. My co-worker Austin has researched all the brokerage accounts and determined that Vanguard is the.

Its a way of creating a portfolio of tax-free money for their futures. Vanguard Fidelity and Schwab all offer custodial Roth IRAs. Children cannot open Roth IRAs themselves.

You can for instance open a Vanguard Roth IRA for a minor with a minimum of 1000 and invest in a variety of mutual funds. Although you may see brokers trumpeting A Roth IRA for Kids as Fidelity Investments does or some such theres nothing special in the way a childs IRA works. For a teens IRA Vanguard spokesman John Woerth recommends Vanguards.

For example you couldnt open a Custodial IRA account for your child at a commission-free brokerage such as Robinhood. How to Open a Roth for Your Child Prerequisite. Where to Open a Roth IRA for Children.

Buying an all-in-one Vanguard Target Retirement Fund requires 1000 minimum investment. How to Open a Roth IRA. A Roth IRA for Kids provides all the benefits of a regular Roth IRA but is geared toward children under the age of 18.

I then make a contribution to each childs custodial Roth IRA up to the amount of income they earn. If a teen. A minor can establish an IRA at Vanguard as long as a parent or custodian signs the adoption agreement.

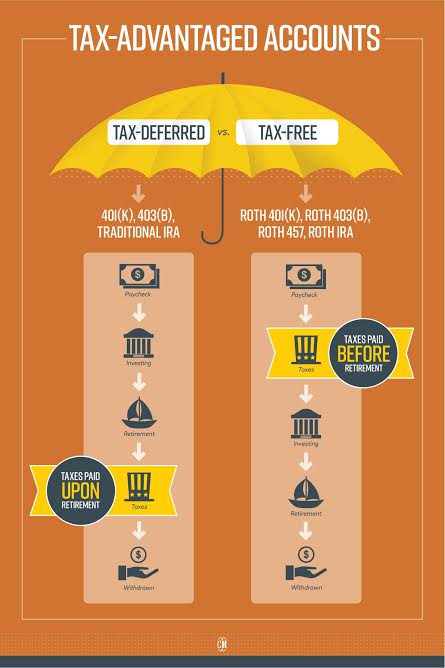

With Vanguard you cant open this type of account online. In this guide well be talking about how to open a Vanguard Roth IRA account if youre below the single filer or married filer income limits mentioned above. Roth IRA rules dictate that as long as youve owned your account for 5 years and youre age 59½ or older you can withdraw your money when you want to and you wont owe any federal taxes.

A Roth IRA is an individual retirement account that offers tax-free growth and tax-free withdrawals in retirement. But the contribution can only be as large as the individuals earned income. Minors cannot generally open brokerage accounts in their own name until they are 18 so a Roth IRA for Kids requires an adult to serve as custodian.

Opening a Roth IRA for kids under 18 is allowed but there are certain rules you have to follow. To be eligible to open a custodial Roth IRA the child must meet all the same requirements as an adult would. The minor must have earned income and contributions are limited to the lesser of total.

The minimum initial investment is 3000 for most funds including the target-retirement. Theres an annual maximum contribution of 6000 per child per year for 2020 and 2021. Move money directly from your bank to your new Vanguard IRA electronically.

Youll just need your bank account and routing numbers found on your bank checks. First off in order to fund a Roth your child has to have earned income. Well send instructions once your IRA is open Avoid the 20 annual account service fee by registering your accounts online and signing up for e-delivery.

These restrictions are easy to bypass by making a backdoor contribution which involves converting a non-deductible Traditional IRA into a Roth IRA. There are income limitations on who can contribute to a Roth IRA however most people should make the cutoff. There is no minimum to open the account.

Open Your Account Online. How to Open an IRA for a Child. Name beneficiaries for your IRA.

So if your child only makes 2000 in a year then they can only put 2000 into the Roth IRA.

Best Roth Ira Accounts Of March 2021 Dollargeek

Best Roth Ira Accounts Of March 2021 Dollargeek

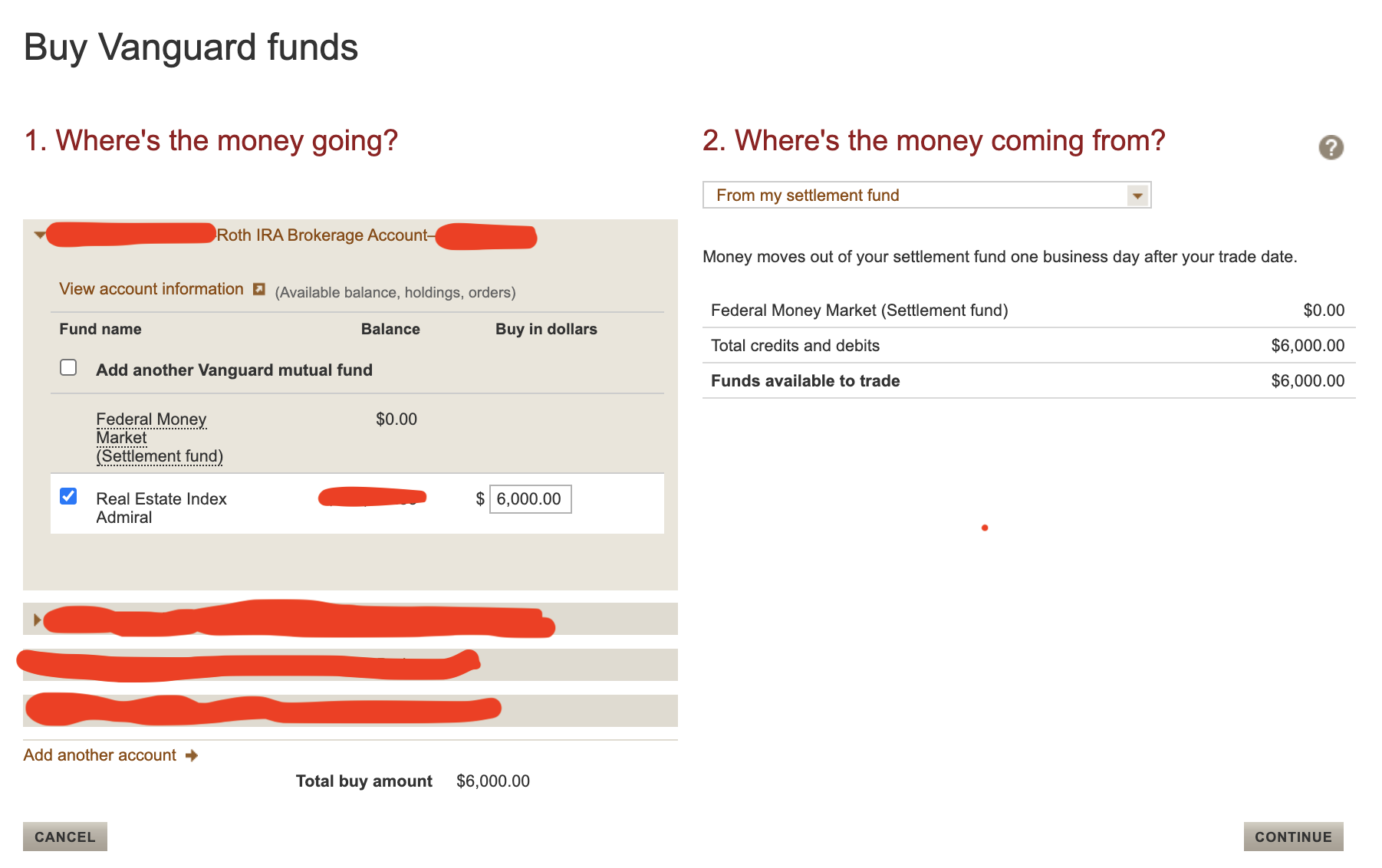

How To Buy Vanguard Index Funds In 2021 Benzinga

How To Buy Vanguard Index Funds In 2021 Benzinga

Vanguard Roth Ira Review Is It The Best Roth For You

Vanguard Roth Ira Review Is It The Best Roth For You

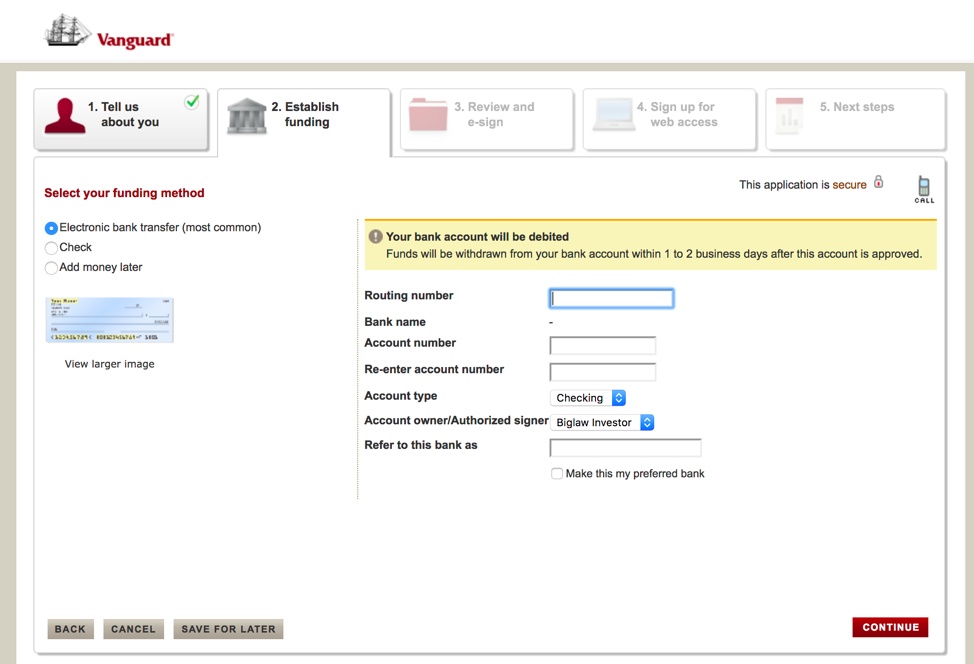

Step By Step Guide To Opening A Vanguard Roth Ira Biglaw Investor

Step By Step Guide To Opening A Vanguard Roth Ira Biglaw Investor

Vanguard Vs Fidelity Which Is Best For You In 2021 Benzinga

Vanguard Vs Fidelity Which Is Best For You In 2021 Benzinga

Vanguard Roth Ira Explained For Beginners Tax Free Millionaire Youtube

Vanguard Roth Ira Explained For Beginners Tax Free Millionaire Youtube

Backdoor Roth Ira Ultimate Guide And Tutorial

Backdoor Roth Ira Ultimate Guide And Tutorial

M1 Finance Vs Vanguard Vs Fidelity Which Is Best For You

M1 Finance Vs Vanguard Vs Fidelity Which Is Best For You

How To Open A Taxable Account At Vanguard Physician Finance Basics

How To Open A Taxable Account At Vanguard Physician Finance Basics

Vanguard Roth Ira For Teenagers In 2021 Teen Financial Freedom

Vanguard Roth Ira For Teenagers In 2021 Teen Financial Freedom

Funding A 3 Year Old S Roth Ira Marotta On Money

Funding A 3 Year Old S Roth Ira Marotta On Money

How To Set Up A Vanguard Ira The Frugal Mermaid

How To Set Up A Vanguard Ira The Frugal Mermaid

Backdoor Roth Ira 2020 Step By Step Guide With Vanguard Physician On Fire Roth Ira Finance Investing Step Guide

Backdoor Roth Ira 2020 Step By Step Guide With Vanguard Physician On Fire Roth Ira Finance Investing Step Guide

Vanguard Roth Ira Account Opening Review Pt Money

Vanguard Roth Ira Account Opening Review Pt Money

My Experience Opening Up A Vanguard Roth Ira Financial Product Reviews

Vanguard Brokerage Services Retirement Account Kit

Vanguard Brokerage Services Retirement Account Kit

First Command Review Don T Do Business With Them

First Command Review Don T Do Business With Them

Best Broker For A Custodial Roth Ira For Your Kids

Best Broker For A Custodial Roth Ira For Your Kids

Post a Comment for "How To Open Roth Ira For Child Vanguard"