How To Void A Prior Year Check In Quickbooks Online

This puts the amount back in the checking account. The first journal entry dated the same day as the original check duplicates the accounting entry of the original check.

To void a check from a closed prior period.

How to void a prior year check in quickbooks online. The original check is voided and the amounts are changed to zeroes. When prompted select Yes to confirm you want to void the check. View this video to learn what you.

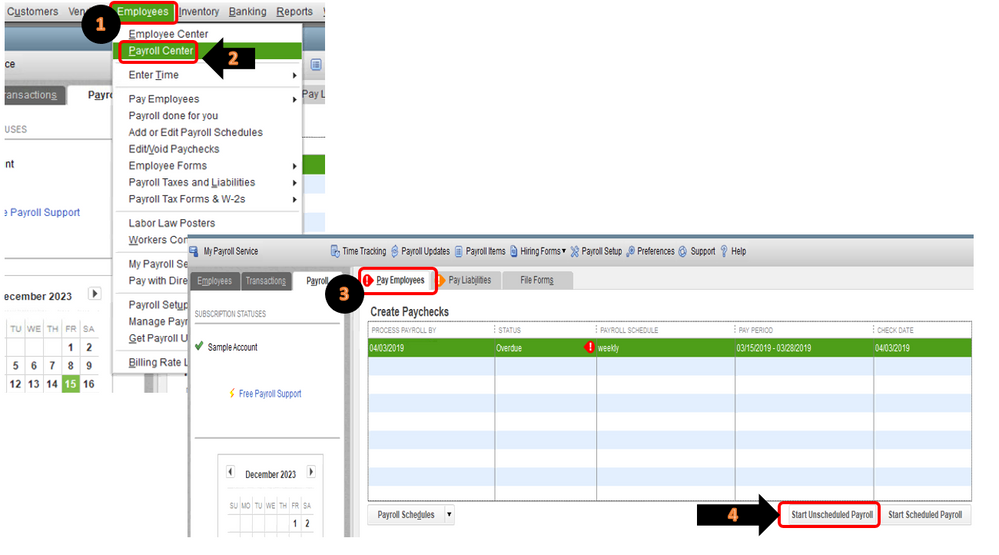

1 From the Check Register find the check you want to void. However prior period income and expenses should not be changed for various reasons such as tax returns having been prepared. In the Type field select Check.

Inside of QuickBooks Desktop when you use the Void feature by finding the check and clicking Edit Void Check it changes the amount to zero this is fine if its in the current period. Do not void the check. Find the check in the register that needs to be voided.

Make a note within the memo that you voided the check and re-issued the check noting the current period date and new check number by way of a journal entry. The usual option is Void Check under the Edit menu. Typically this will affect expense and bank accounts.

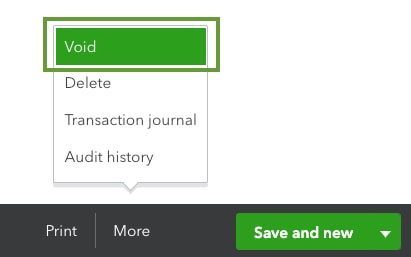

Try contacting them to see if they have received the check. In such cases you can use quickbooks to void a check before finalizing the transaction. Select More and select Void from the pop-up menu.

If the customer does not have the check you will need to re-write the check and send it to them. That IS the reversing entry not in the Background but in the File. Double click on the entry to view the check.

QuickBooks voids the check as of the original check date prior accounting period and no journal entries are created. Use this method when the check is older from a previous year or quarter when tax returns or financial statements have al. This video will show you how to void a check from a Prior Year in QuickBooks.

Then you will need to void the old check and note in the memo line the check number you are replacing it with. One way to write off checks is to select the check in the register and void it through the Edit menu clicking on Void Check Voiding a check changes the dollar amount to 0 but keeps the empty transaction. To the beginning of the.

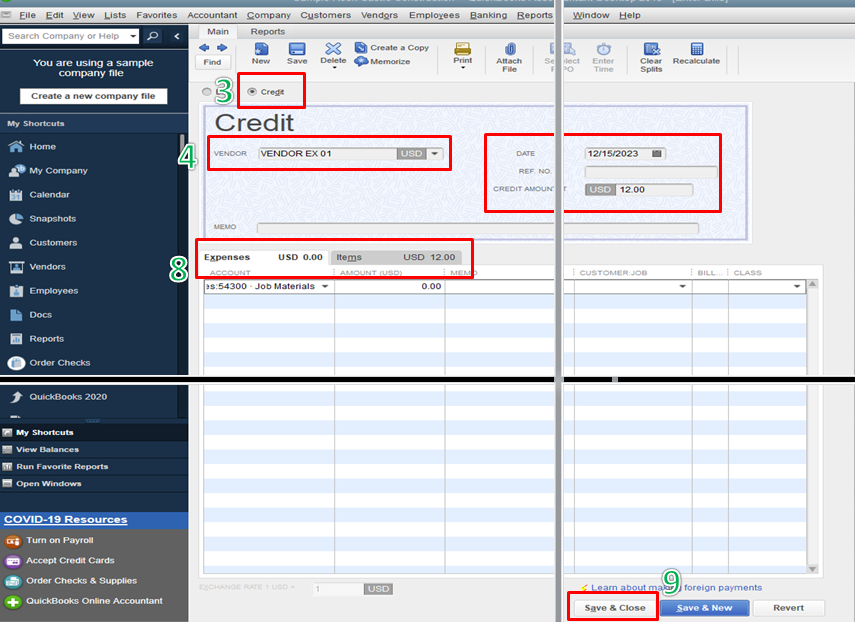

3 QuickBooks will create two general journal entries. The checks variety receiver and date likewise in such cases youll use quickbooks to void a check before settling the trade. Quickbooks check marked as void.

How to void a check from a prior period. Choose Save Close. The original check is voided and amounts are changed to zero.

Select the check to void from the Expense Transactions list to open it in the Check screen. Let you choose the void date then make the reverse entry in the background. You choose to make the Offsetting entry so that you control the date.

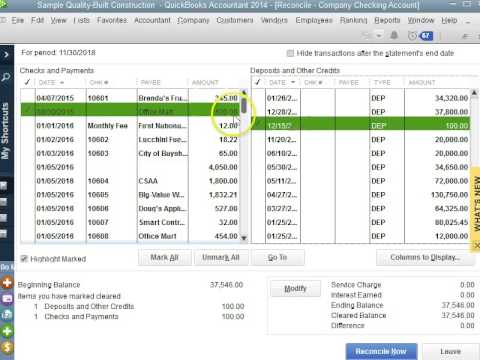

Use all the same payee amount and expense account as the check you want to void. When you reconcile your bank account be sure to clear both the outstanding voided check and the deposit. Then QuickBooks creates two general journal entries.

Cancelling and voiding checks in quickbooks online. Click Expenses and select your Clearing Account from the list of options. You should not just delete or void the check.

Its important to immediately adjust your quickbooks bank balance so the correct amount is displayed. Voided check means that you cancel out the original transaction but the record of the check remains in your quickbooks online account. Void a check from prior fiscal year After the Prior year check is voided you need to do a GJE to make sure the prior year balance sheet remains the same and the reversal recorded in the current periodyear.

Find the check to be voided either in the register or on a QuickBooks report. Go to Banking at the top menu bar then select Write Checks. Or Void the check in the current period and have QuickBooks create journal entries to keep your prior period reports accurate.

Enter the information for the check including the payee check number date and check total. Take note of which accounts are being affected. 2 QuickBooks message will pop up.

Click on Edit and click Void Check. Void the check as of the original transaction date prior accounting period. Void a check without opening the transaction.

Instead of voiding or deleting a QuickBooks transaction from the previous year you can enter a deposit using the current year date you want to void the check. Put in the description the Check s that you are voiding. However this takes the original transaction and changes the amount to 0.

Its just the Opposite process. In the memo field make a note that the check is being voided with a deposit entry as of a current date. In this case you can select the Yes Recommended.

QuickBooks clients often need to void checks that were written in a prior period. Select the date range in which the check was received and select Apply. If try this in a closed period you will get this pop-up message.

How to void a check in QuickBooks. Enter a deposit in the current period for the total amount and post it to principal interest accounts.

Void Or Delete Transactions In Quickbooks Online

Void Or Delete Transactions In Quickbooks Online

Quicktips Voiding Checks From Prior Periods By Quickbooks Made Easy Youtube

Quicktips Voiding Checks From Prior Periods By Quickbooks Made Easy Youtube

Vati Rn Comprehensive Predictor 2019 Form A2 This Document Contains 180 Questions And Answers This Or That Questions Practice Exam Catheter Insertion

Vati Rn Comprehensive Predictor 2019 Form A2 This Document Contains 180 Questions And Answers This Or That Questions Practice Exam Catheter Insertion

Cpa Automation Automation Of The Tax Accounting Process Quickbooks How To Memorize Things Accounting Process

Cpa Automation Automation Of The Tax Accounting Process Quickbooks How To Memorize Things Accounting Process

Voiding A Check In A Written Period How To Void A Check In Quickbooks

Solved How Do I Void An Invoice From Last Year In Qbo

How To Void A Check In Quickbooks Experts In Quickbooks Consulting Quickbooks Training By Accountants

How To Void A Check In Quickbooks Experts In Quickbooks Consulting Quickbooks Training By Accountants

How To Void A Check From A Prior Year In Quickbooks Youtube

How To Void A Check From A Prior Year In Quickbooks Youtube

Void A Check In Quickbooks Voiding Checks Qb Pro Premier Enterprise

Import Bank Transactions Using Excel Csv Files In Quickbooks Quickbooks Quickbooks Online Excel

Import Bank Transactions Using Excel Csv Files In Quickbooks Quickbooks Quickbooks Online Excel

Post a Comment for "How To Void A Prior Year Check In Quickbooks Online"