How To Set Up A Simple Ira In Quickbooks

Select Custom Setup and click Next. Excel is easier for just that one item.

Quickbooks Payroll Set Up How To Enter Payroll Service Key Fourlane Quickbooks Quickbooks Payroll Payroll

Quickbooks Payroll Set Up How To Enter Payroll Service Key Fourlane Quickbooks Quickbooks Payroll Payroll

When you reach this point in the setup QuickBooks will suggest Payroll Liabilities.

How to set up a simple ira in quickbooks. The employee owns and controls the SIMPLE IRA. Mark to select the SEP IRA check and. There are three steps to establishing a SIMPLE IRA plan.

Enter a description or the name of the provider for the retirement plan. Go to Lists and choose Payroll Item List. How to set up SEP ira in QB desktop.

After your SIMPLE IRAs are set up you and your employees can choose to make regular pre-tax contributions through payroll deductions. From the QuickBooks Lists menu choose Payroll Item List to open the Payroll Item List window. Choosing the SIMPLE IRA-Company Portion and clicking on the Edit button brings up the following screen.

Select Company Contribution and click Next. QuickBooks will also suggest Payroll Expenses as the expense account. We want QuickBooks to show the SIMPLE IRA company contribution amounts to show as due by the 10 th of the following month.

Each of these plans can be set up with a catchup provision to allow higher deductions for qualifying older employees. To set up a retirement plan company contribution item using Custom Setup. We should set the employee deduction item for the IRA contributions to the same schedule.

Select Custom Setup and click Next. Execute a written agreement to provide benefits to all eligible employees. From the QuickBooks Desktop menus at the top click Lists Payroll Item List.

Click Payroll Item List. Set up company contributions. A 401k-style experience with a plan-level advisor relationship.

Go to Employees and choose Payroll Center. In the Other Activities section click on the Create Custom Payments link. Form 5305-SA a custodial account.

Those payroll items still exist in the sample file. An IRA is a long-term asset so make one up in that category. Just use a spreadsheet.

On Form W-2 for employee compensation SIMPLE IRA contributions made by the employee are deducted from the wages tips. At the lower left of the Payroll Item List click the Payroll Item button New. If you have any query related to QuickBooks accounting software then contact to Caro Associates LLC.

At the lower left of the Payroll Item List click the Payroll Item button New. One for employee deduction one for company match including corresponding expense account. Cost typically lower than 401k A 25 one-time setup fee and an annual 25 fee both per participant.

The 401k SIMPLE 401k 403b SARSEP and SIMPLE IRA plans are tax-deferred. How to set up SEP IRA contribution. Using a separate account though gives us a much greater ability to track down any discrepancies should one occur.

Moreover how do I set up a simple IRA company match in QuickBooks. You can set up SIMPLE IRAs with banks insurance companies or other qualified financial institutions. Three Steps to Set up a SIMPLE IRA Plan.

To do this task please follow these steps. Your SEP IRA grows tax-deferred until you make withdrawals. Select the Pay Liabilities tab.

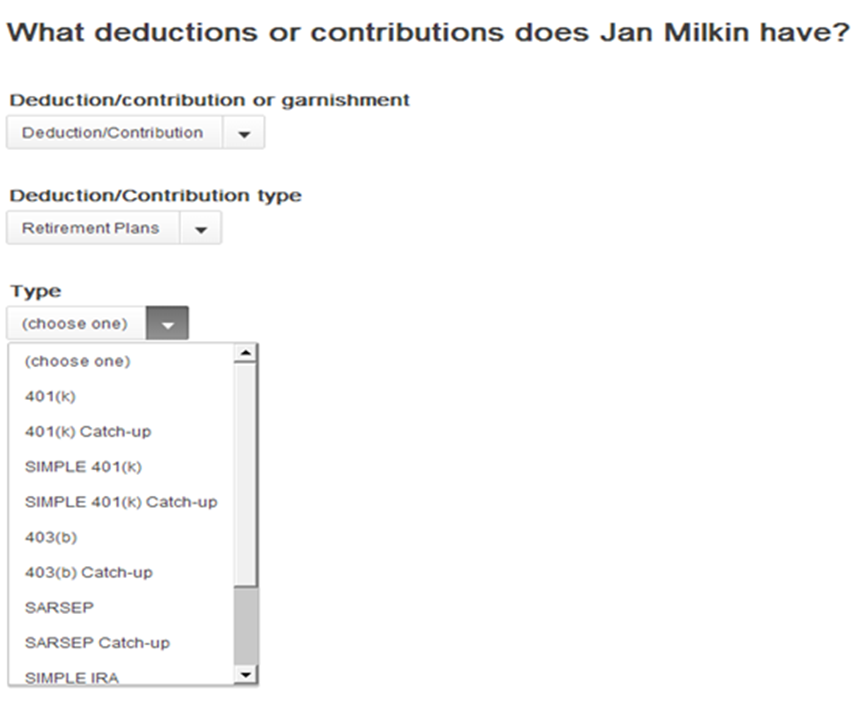

The first account SIMPLE IRA Payable is a current liability account. Select the type of retirement plan you want to set up from the Type drop-down including Simple 401 k Simple IRA or After-tax Roth 401 k. How to set up SEP Ira in QB pro desktop payroll enhanced.

Set the date range and click on OK. You can also pick how your money gets invested. According to QB instructions I am to set up 2 payroll items.

Select Deduction and click Next. What expense account do I use. To create the liability check to pay the retirement plan administrator i.

Click on the Payroll Item drop down and select New. We have made a selection in this window. Were starting a simple IRA plan for our small office.

Set up an IRA account for each employee. From the QuickBooks Desktop menus at the top click Lists Payroll Item List. Select Retirement Plans from the DeductionContribution type drop-down.

Microsoft Money was capable of keeping records on an individual account basis such as for a specific 401k or Roth IRA as well as the entire householdIt handled dividend reinvestment programs calculated each positions tax basis and pulled real-time updates from internet stock quotes to give up-to-date information. Set up a SIMPLE IRA for each eligible employee using either IRS model. Choose Custom Setup allows editing of all settings.

How do I set up company contributions in QuickBooks. Give employees certain information about the agreement. Select Custom Setup and click Next.

In the Agency for employee-paid liability window choose the correct vendor name. If you are using QB for your personal finances. Execute a Written Agreement.

The SIMPLE 401k and SIMPLE IRA plans differ primarily in the areas of employee eligibility loan provisions and company contribution limits. For example you can set up your account to invest in mutual funds. Click the Payroll Item button and choose New to open the Add new payroll item window.

In addition to many of the same benefits as a SIMPLE IRA SIMPLE IRA Plus offers. Click Lists at the top. Right-click on the Simple IRA employeeemployer item then click Edit Payroll Item.

Most small businesses with 100 or fewer employees can set up a SIMPLE IRA. To set up a retirement plan company contribution item using Custom Setup. Form 5305-S a trust account or.

Recommended for expert users and click on Next.

Here S A Method That Will Help Resolve Quickbooks Error 15222 Quickbooks Antispyware Technical Glitch

Here S A Method That Will Help Resolve Quickbooks Error 15222 Quickbooks Antispyware Technical Glitch

Retirement Plan Deductions Contributions

Retirement Plan Deductions Contributions

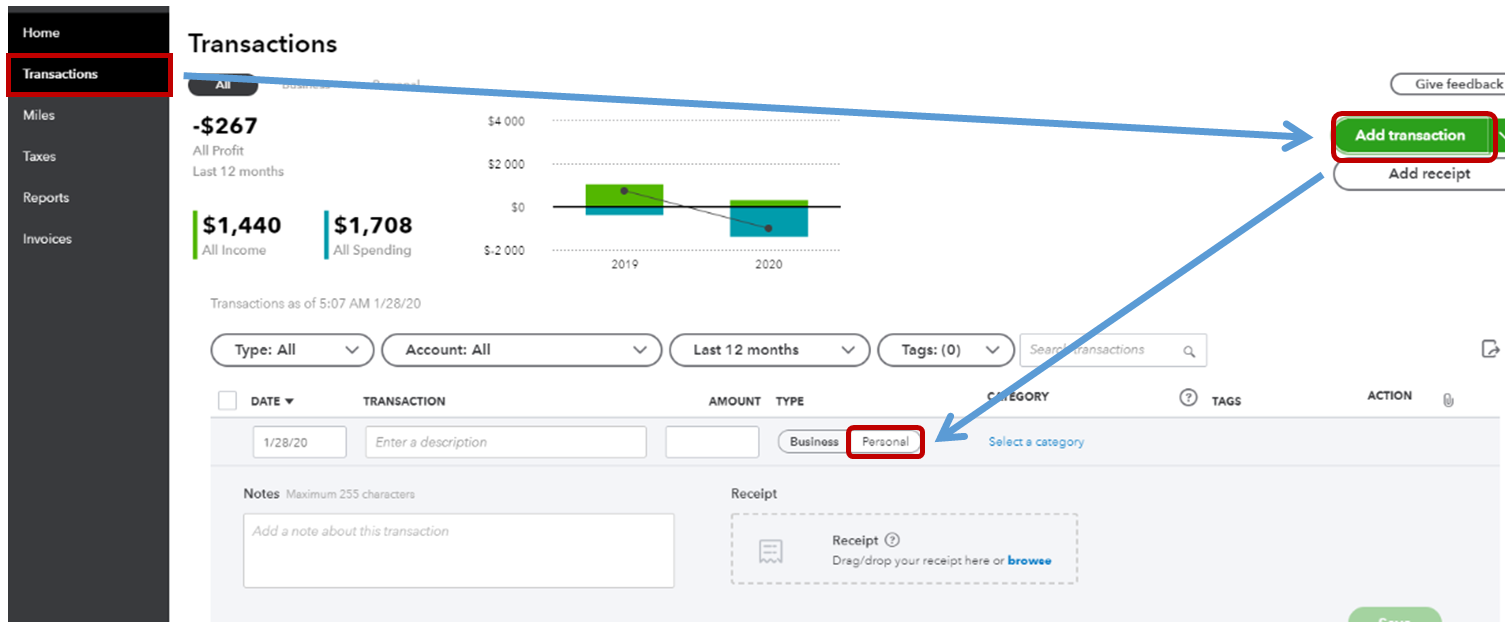

How To Set Up The Chart Of Accounts In Quickbooks Online Chart Of Accounts Quickbooks Quickbooks Online

How To Set Up The Chart Of Accounts In Quickbooks Online Chart Of Accounts Quickbooks Quickbooks Online

Update Quickbooks Desktop To The Latest Release Quickbooks Quickbooks Help Software Update

Update Quickbooks Desktop To The Latest Release Quickbooks Quickbooks Help Software Update

Create A P In Quickbooks Statement Template Profit And Loss Statement How To Memorize Things

Create A P In Quickbooks Statement Template Profit And Loss Statement How To Memorize Things

Doug Sleeter On About Me Quickbooks Quickbooks Online Small Business Resources

Doug Sleeter On About Me Quickbooks Quickbooks Online Small Business Resources

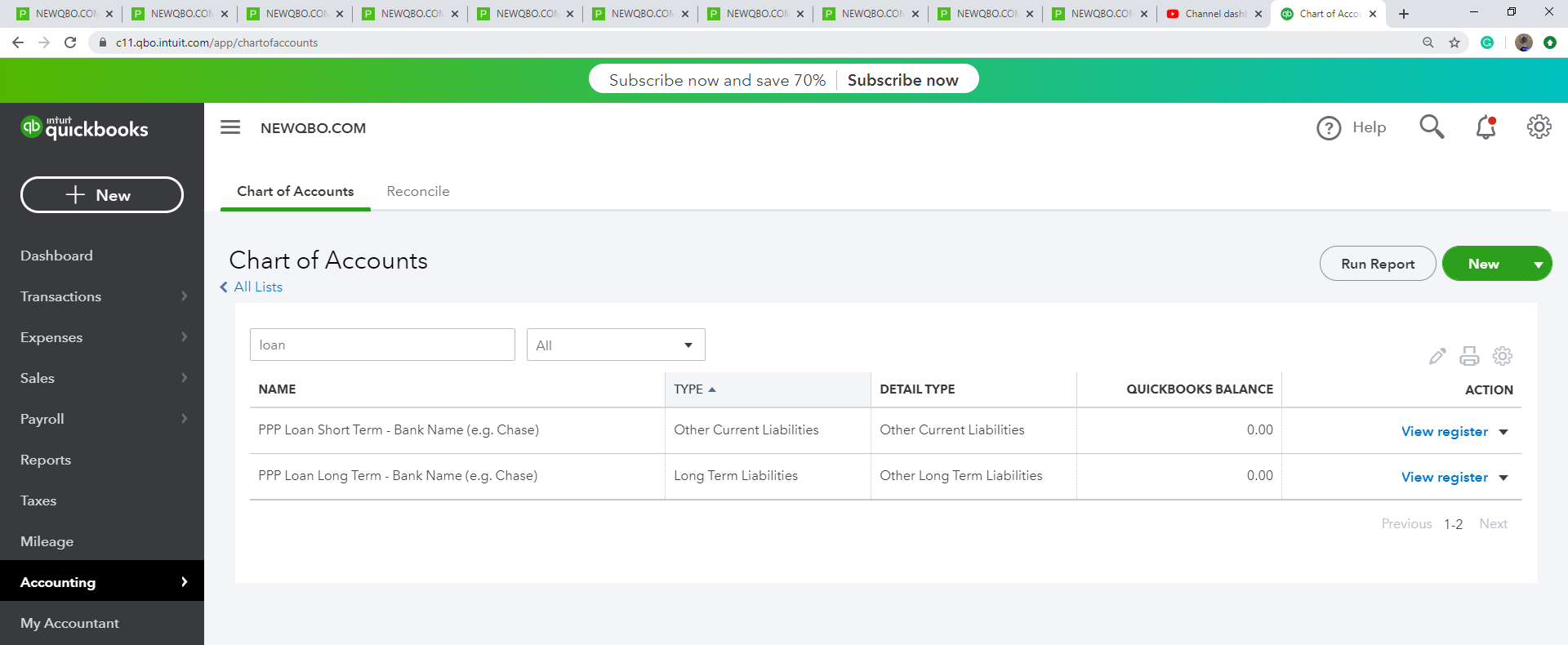

Chart Of Accounts Template Uncommon Non Profit Accounting Software Quickbooks Desktop Enterpr Chart Of Accounts Non Profit Accounting Accounting

Chart Of Accounts Template Uncommon Non Profit Accounting Software Quickbooks Desktop Enterpr Chart Of Accounts Non Profit Accounting Accounting

How To Reprint Checks In Quickbooks Quickbooks Payroll Checks Told You So

How To Reprint Checks In Quickbooks Quickbooks Payroll Checks Told You So

A Simple Guide For Quickbooks Cash Flow Forecasting Tools In 2020 Quickbooks Quickbooks Online Cash Flow Statement

A Simple Guide For Quickbooks Cash Flow Forecasting Tools In 2020 Quickbooks Quickbooks Online Cash Flow Statement

Quickbooks Management Reports Step By Step Guide Quickbooks Quickbooks Online Management

Quickbooks Management Reports Step By Step Guide Quickbooks Quickbooks Online Management

Quickbooks Basics For Nonprofits Sponsored How To Use Quickbooks Online Business Courses Quickbooks

Quickbooks Basics For Nonprofits Sponsored How To Use Quickbooks Online Business Courses Quickbooks

Full Quickbooks Course Part 3 Of 3 Sales Tax Quickbooks Quickbooks Tutorial Sales Tax

Full Quickbooks Course Part 3 Of 3 Sales Tax Quickbooks Quickbooks Tutorial Sales Tax

What Are The Specific Reports Available In Simple Start Version Of Quickbooks Online Newqbo Com Quickbooks Quickbooks Online Accounts Payable

What Are The Specific Reports Available In Simple Start Version Of Quickbooks Online Newqbo Com Quickbooks Quickbooks Online Accounts Payable

Post a Comment for "How To Set Up A Simple Ira In Quickbooks"