How To Open A Roth Ira Td Bank

You can open a Roth IRA at any online broker or robo-advisor typically online in about 15 minutes. Empowering Education - We offer exclusive videos useful tools and webcasts to help you create a personalized retirement plan.

Best Places To Open A Roth Ira In 2021

Best Places To Open A Roth Ira In 2021

One of two ways.

How to open a roth ira td bank. The process is easy as can be. Know your fees The 401k fee analyzer tool powered by FeeX will show you how much youre currently paying in fees on your old 401k. Its my pleasure to present Ben Barker from Accuplan so welcome Ben and also thanks for joining us today.

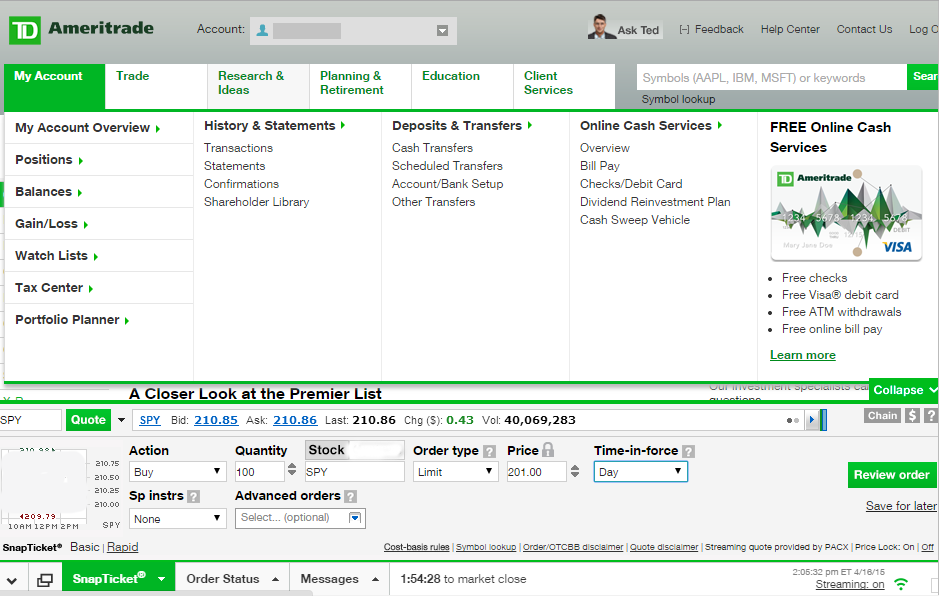

TD Ameritrade is a trademark jointly owned by TD Ameritrade IP Company Inc. If you have an existing traditional IRA the same company can probably open a Roth IRA for you. The first option is a traditional IRA and the second option is a Roth IRA named for the accounts congressional sponsor which features -- among other benefits -- the ability to receive tax-free earnings under certain circumstances.

To start with the owner of the Roth IRA should not. If your bank doesnt offer Roth IRA accounts you can open one with a brokerage firm. Im delighted to be below.

Almost all investment companies offer Roth IRA accounts. This period begins January 1 of the year of the first contribution to any Roth IRA account. Decide Where to Open Your Roth IRA Account.

800-213-4583 to speak with a rollover specialist. The information education and general descriptions contained herein are provided solely for informational and educational purposes. Learn about TD Banks Preferred Savings IRA a high interest IRA savings account with higher rates when you bundle your TD accounts.

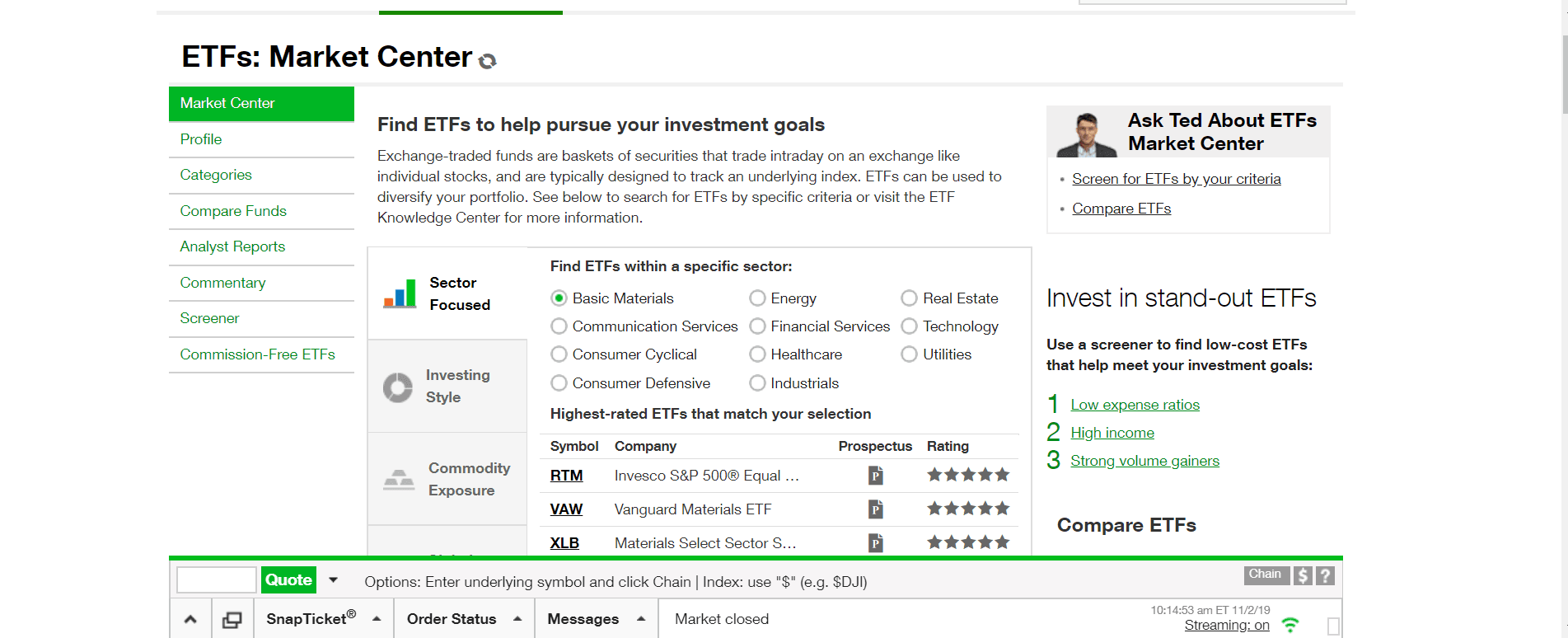

Why open a TD Ameritrade Roth IRA. Td bank Roth IRA options. Smart Tools Plan and evaluate your retirement strategy with helpful tools like the IRA.

But you dont have to handle the process on your own. Knowing how to open a Roth IRA starts with knowing your investing preferences. Contact the administrator of your previous employer-sponsored retirement plan to request the appropriate rollover forms.

Choosing a Roth IRA provider. You are not required to start taking distributions from a Roth IRA at age 70½ as you are with a traditional IRA and you can continue to contribute as long as you have earned income. Currently weve been working together for several years currently as well as I can testify a lot of sector expertise.

Apply online Call. Visit a store and open an account today. For answers to your other IRA questions or for more information on a Traditional vs.

For example you can open a Bank of America Roth IRA. Figuring out where to open your Roth can get complicated partly because some banks also have investment advisories. Savings for retirement A TD Simple Savings IRA may be a good choice if you are starting to save for retirement it has a low minimum balance and provides the flexibility to make contributions at any time 2.

TD Ameritrade Holding Corporation is a wholly owned subsidiary of The Charles Schwab Corporation. If youre a do-it-yourself investor choose a brokerage. You can open a Roth IRA at an online broker and then choose.

The Retirement Calculator estimates if youre on track to meet your investment goal and the IRA Selection Tool can help determine whether a Roth or Traditional IRA is right for you. If you already have a TD Ameritrade IRA skip directly to step 2. Is a subsidiary of TD Ameritrade Holding Corporation.

Investors have two options for their individual retirement accounts IRAs. Open a new TD Ameritrade IRA in. And The Toronto-Dominion Bank.

Roth IRA owners who want to transfer their account to a new custodian can avoid taxes and penalties if they follow some relatively simple rules. Visit a TD Bank to open an account now. Breadth of Investment Choices - Including commission-free ETFs no-transaction-fee mutual funds 1 fixed income products and much more.

There is a single 5-year holding period when determining whether earnings can be withdrawn federal and in most cases state income tax-free as part of a qualified distribution from a Roth IRA. Most large firms also offer online access to start the account application. Td Bank Roth IRA Options.

Td bank Roth IRA options. Free automatic transfers Kick-start your retirement savings with free incoming transfers from other accounts. Opening a Roth IRA can be as simple as visiting your banks website and filling out an online application.

Roth IRA please contact our IRA Department at 1-800-231-8193 and listen carefully to the options. Learn about TD Banks IRA Add-Vantage CD a 12 month IRA CD where you can continually add funds whenever you want to save for retirement. When a Roth IRA owner dies however his or her beneficiaries must adhere to the same minimum distribution rules that apply to traditional IRAs.

Td Ameritrade Review 2021 Iras Options Trading Hsas

Td Ameritrade Review 2021 Iras Options Trading Hsas

Backdoor Roth Ira Ultimate Guide And Tutorial

Backdoor Roth Ira Ultimate Guide And Tutorial

Traditional And Roth Iras Simple Steps For A Retirement Portfolio Course Youtube

Traditional And Roth Iras Simple Steps For A Retirement Portfolio Course Youtube

Backdoor Roth Ira Ultimate Guide And Tutorial

Backdoor Roth Ira Ultimate Guide And Tutorial

Traditional And Roth Ira Costs To Know Td Ameritrade

Traditional And Roth Ira Costs To Know Td Ameritrade

How To Close Td Ameritrade Account Closing Fee 2021

How To Close Td Ameritrade Account Closing Fee 2021

Here S Your Td Ameritrade Routing Number Gobankingrates

Here S Your Td Ameritrade Routing Number Gobankingrates

Starting Early Traditional Roth Ira For Kids Ticker Tape

Starting Early Traditional Roth Ira For Kids Ticker Tape

Td Ameritrade Review My Experience Using Td Ameritrade

Td Ameritrade Review My Experience Using Td Ameritrade

![]() Td Bank Savings Account 2021 Review Should You Open

Td Bank Savings Account 2021 Review Should You Open

Td Ameritrade Ira Review Roth Rollover Account Fees 2021

Td Ameritrade Ira Review Roth Rollover Account Fees 2021

Td Ameritrade Ira Fees Roth Retirement Account Cost 2021

Td Ameritrade Ira Fees Roth Retirement Account Cost 2021

How To Open A Roth Ira With Td Ameritrade Walkthrough Youtube

How To Open A Roth Ira With Td Ameritrade Walkthrough Youtube

Starting Early Traditional Roth Ira For Kids Ticker Tape

Starting Early Traditional Roth Ira For Kids Ticker Tape

Post a Comment for "How To Open A Roth Ira Td Bank"