How To Void A Damaged Check In Quickbooks

The following fields must be completed the other fields are optional. Review the voided transaction then click Save Close.

Select Accounting from the left menu.

How to void a damaged check in quickbooks. Void the Regular Check Open the check register again find the Regular check that you just created right-click it and click Void Check. You can void a check from the Check page which lets you review the details of the original transaction. How to void a check from a prior period.

To void a check-in QuickBooks the person tasked with the job will need to access the software and log into the account. Select the check to void from the Expense Transactions list to open it in the Check screen. Ou must first locate the voided transaction.

From there the user needs to find the appropriate account. You can also void a check already recorded in QuickBooks Online. On the Expenses tab select Filter.

Its just the Opposite process. Do not void the check. Select the date range in which the check was received and select Apply.

Typically this will affect expense and bank accounts. In order to unvoid a check in quickbooks you essentially have to record the original transaction again. If you want to void a check that has already been recorded youll need to take a different approach.

However this takes the original transaction and changes the amount to 0. Voiding a Check Within QuickBooks 1 Click Banking and then Use Register Click on the account the check was written from. Then navigate to Use Register.

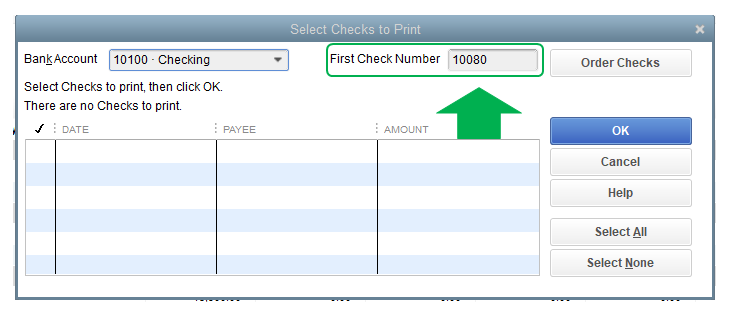

Check Payment date. In the memo field make a note that the check is being voided with a deposit entry as of a current date. Find and click the bank account with the check you want to void.

That IS the reversing entry not in the Background but in the File. To void a check first open the check to void and display it in the Write Checks window. To answer your question if you wish to physically void the checks you do that and write VOID on them and then hang onto them for 3-7 years depending on other hold requirements for records.

After you open up the voided transaction you should then select more on the page of the transaction. When Are you sure you want to void this prompts select Yes. Type any additional details about the transaction in the Memo.

Select More and Void. Select audit history and show all for the transaction details. This involves logging in to your account and choosing Accounting Chart of Accounts View Register for the bank account associated with the voided check highlight the check Edit More Void.

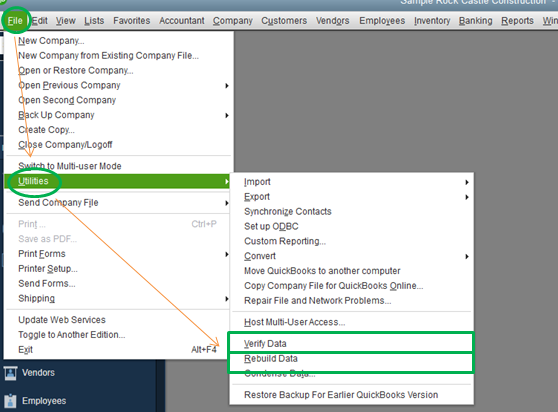

However depending upon which method you use you may unintentionally alter your financial reports. The usual option is Void Check under the Edit menu. Then select Edit Void Check from the Menu Bar to void the check shown in the Write Checks window.

Let you choose the void date then make the reverse entry in the background. The date of the transaction is the date the change of the dollar amount of the transaction will be effective. Under Vendors select Check.

Select the bank account the check you need to void was recorded under and choose View. Double click on the entry to view the check. Your books done right - guaranteed.

Select Chart of Accounts at the top. When the check hasnt been cashed and wasnt included in your previous reconciliation you can void it by following the steps below. Open the check in the Write Checks window.

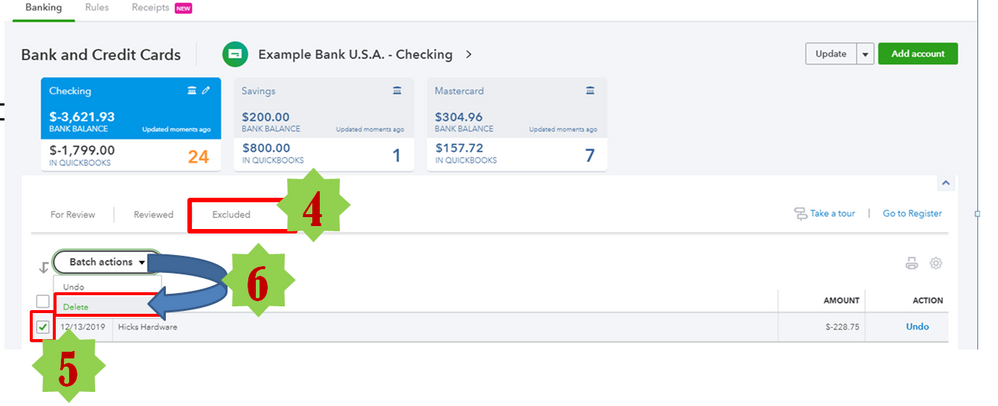

In the Type field select Check. You choose to make the Offsetting entry so that you control the date. Pick VIEW REGISTER Find the check you need and click on it to highlight and select EDIT You need to clik MORE on the bottom center and pick VOID.

But in the non-attorney world if for example a check is damaged in the printer or gets wet we do not VOID we just SHRED. There are two ways that these checks can be voided when using QuickBooks. One way to write off checks is to select the check in the register and void it through the Edit menu clicking on Void Check.

Note that VOID has been inserted in the Memo field. You can void a check in QuickBooks Desktop Pro that you have created if necessary. Make a note within the memo that you voided the check and re-issued the check noting the current period date and new check number by way of a journal entry.

Find the check in the register that needs to be voided. The user must head to the Banking option. Find the check to be voided either in the register or on a QuickBooks report.

From the menu select Edit Void Check. To void a check. Take note of which accounts are being affected.

Quickbooks Connection Diagnostic Tool Diagnostic Tool Quickbooks Connection

Quickbooks Connection Diagnostic Tool Diagnostic Tool Quickbooks Connection

Pin On Quickbooks Enterprise Errors

Pin On Quickbooks Enterprise Errors

How To Setup Quickbooks Inventory Tracking Tutorial Quickbooks Inventory Management Software Tracking Software

How To Setup Quickbooks Inventory Tracking Tutorial Quickbooks Inventory Management Software Tracking Software

How To Void Reprint And Issue A Lost Paycheck In Quickbooks Software Solutions 844 888 4666 Call Now Accounting Helpline

Get Our Image Of Generic Direct Deposit Form Template Quickbooks Payroll Quickbooks Best Tax Software

Get Our Image Of Generic Direct Deposit Form Template Quickbooks Payroll Quickbooks Best Tax Software

Guide Update And Install Quickbooks Database Server Manager In 2020 Quickbooks Management Server

Guide Update And Install Quickbooks Database Server Manager In 2020 Quickbooks Management Server

How To Unvoid A Check In Quickbooks Safely Quickbooks How Are You Feeling Chart Of Accounts

How To Unvoid A Check In Quickbooks Safely Quickbooks How Are You Feeling Chart Of Accounts

How To Reissue A Check In Quickbooks Process To Void A Check

How To Reissue A Check In Quickbooks Process To Void A Check

Perform Void Reprint And Issue Of Lost Paycheck In Quickbooks Quickbooks How To Use Quickbooks Data Services

Perform Void Reprint And Issue Of Lost Paycheck In Quickbooks Quickbooks How To Use Quickbooks Data Services

Quickbooks Error Code 6123 0 How To Fix Resolve Support Quickbooks Error Code Coding

Quickbooks Error Code 6123 0 How To Fix Resolve Support Quickbooks Error Code Coding

Quickbooks Crm Api In 2021 Crm Quickbooks Crm System

Quickbooks Crm Api In 2021 Crm Quickbooks Crm System

How To Resolve The Quickbooks Update Error 1328 Quickbooks Quickbooks Help Fix It

How To Resolve The Quickbooks Update Error 1328 Quickbooks Quickbooks Help Fix It

Quickbooks Backup Fails Accountingerrors Quickbooks Backup Document Writer

Quickbooks Backup Fails Accountingerrors Quickbooks Backup Document Writer

Post a Comment for "How To Void A Damaged Check In Quickbooks"