How To Start A Roth Ira Chase

The Roth IRA account is one of the very best financial accounts anyone can have. In 2020 the Roth IRA contribution limit is 6000 or 100 of income a child earns whichever is less.

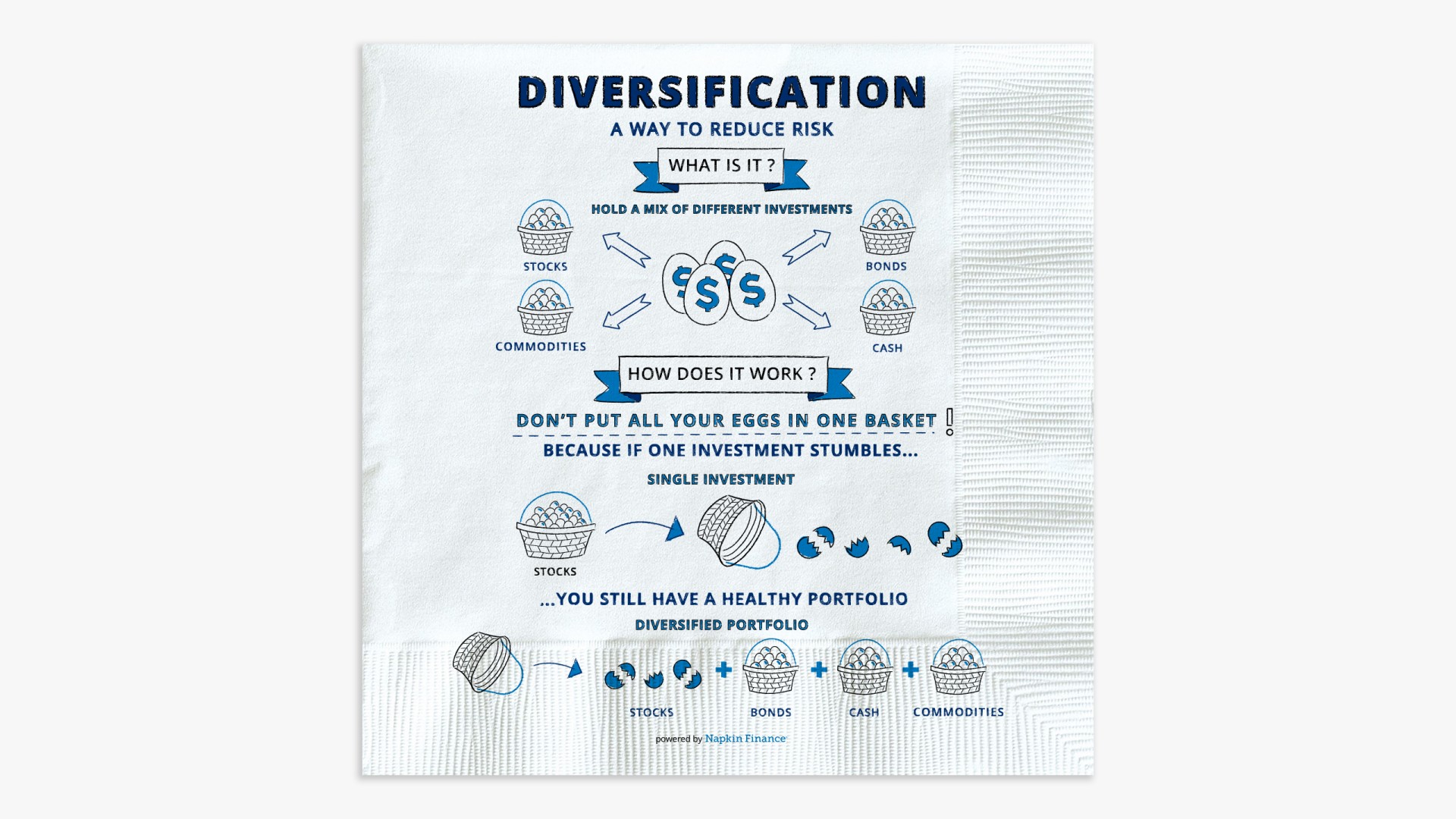

How To Diversify Learning And Insights Chase Com

How To Diversify Learning And Insights Chase Com

Opening a Roth IRA can be as simple as visiting your banks website and filling out an online application.

How to start a roth ira chase. There is a single 5-year holding period when determining whether earnings can be withdrawn federal and in most cases state income tax-free as part of a qualified distribution from a Roth IRA. Education Planning Funding for education can come from any combination of options and a JP. Qualified distribution is any payment or distribution from your Roth IRA that meets the following requirements.

However Chase requires 50000 in assets 100000 in some cases to open an IRA through this channel. Use a Roth IRA. You can open a Roth IRA at an online broker and then choose.

This period begins January 1 of the year of the first contribution to any Roth IRA account. The Roth IRA allows workers to contribute to a tax-advantaged account let the money grow tax-free and never pay taxes again on withdrawals. How to Start a Roth IRA.

Chase IRA account rates bank fees pros and cons. But you dont have to handle the process on your own. To help you with your search for the best Roth IRA account we compared more than 30 financial companies to find out which ones offer the best Roth IRA accounts in terms of investment options investment help and fees involved.

If youre a do-it-yourself investor choose a brokerage. They have different tax benefits and different rules. Open an account and make contributions.

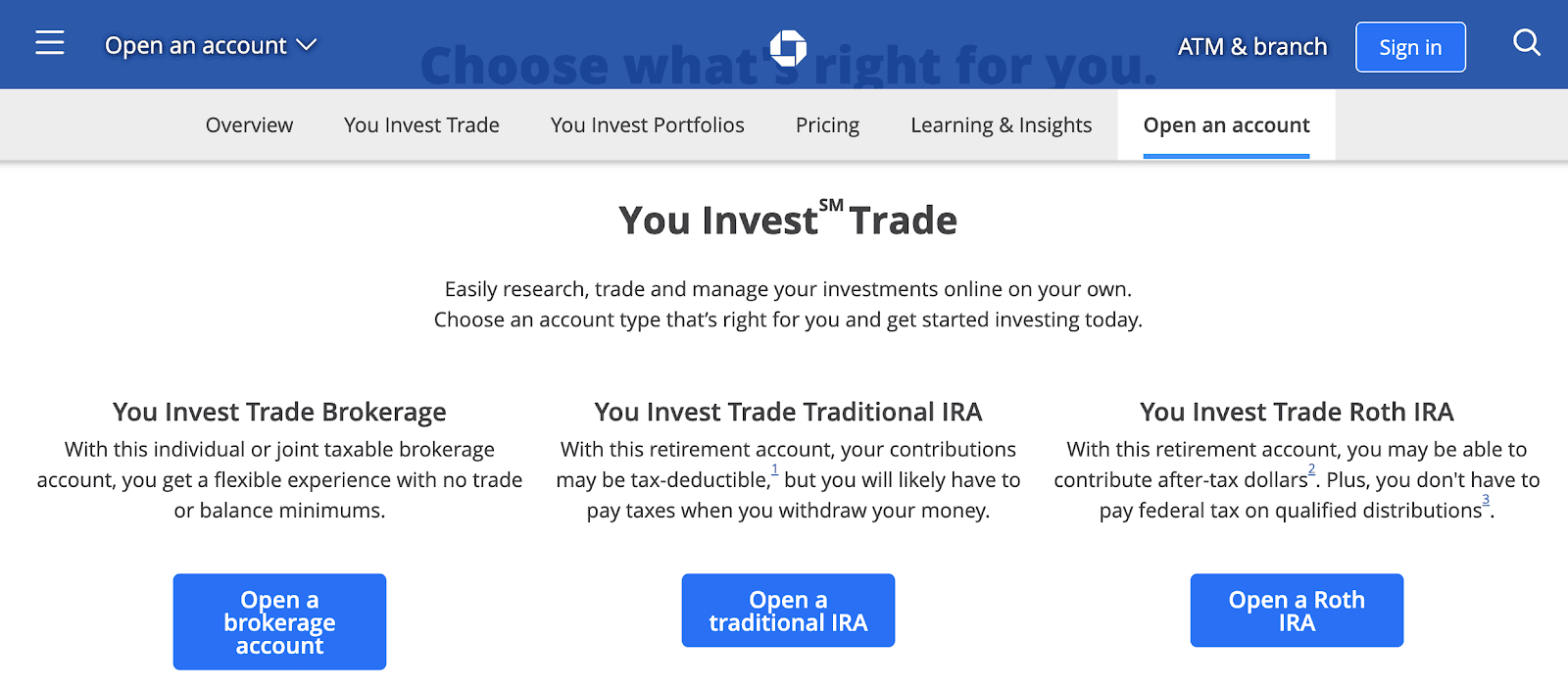

Pay your future self by investing in an IRA and you can also lower your income tax bill. An IRA can help your child or grandchild save for retirement a first home or educational expenses. Apply to open a You Invest Trade IRA here.

Like confiscation of gold and silver you know although there are dangers with any kind of financial investment we merely want to clear up the misconceptions as well as give you a better understanding of the versatility that you actually have with these retirement vehicles. Apply to open a You Invest Portfolios IRA here. There are a ton of online brokerage firms that let you open a Roth IRA and invest in various funds.

Open an account and make contributions. 1 It is made after the 5-year period beginning with the first taxable year for which a contribution was made to a Roth IRA set up for your. Clever retirement investors know an even better strategy to minimize their taxes though.

You can open a Roth IRA at any online broker or robo-advisor typically online in about 15 minutes. Most large firms also offer online access to start the account application. Rollover your account from your previous employer and compare the benefits of Brokerage Traditional IRA and Roth IRA accounts to decide which is right for you.

Knowing how to open a Roth IRA starts with knowing your investing preferences. Morgan advisor please go to your local Chase branch. This option comes with a one-on-one working relationship with a traditional human advisor.

Open an account for roth IRA through robo advisor Work with a JP Morgan Advisor Get a free investment check-up to make sure youre still on track to meet your financial goals. Morgan Advisor can help you understand the benefits and disadvantages of each one. Does chase private client have fees to open a Roth IRA.

You can learn more about IRAs here PDF. With its new brokerage firm You Invest you can open a retirement account with almost no. Individual Retirement Accounts with Chase If youre searching for a low-cost IRA Chase may have an answer for you.

You could open a SIMPLE IRA through the wealth management division of JPMorgan Chase in addition to the other IRAs Chase offers. But most people dont fully understand how the work or how to use them that will maximize their true long-term. If your bank doesnt offer Roth IRA accounts you can open one with a brokerage firm.

Education Planning Funding for education can come from any combination of options and a JP. A Roth IRA offers many benefits to retirement savers. Rollover your account from your previous employer and compare the benefits of Brokerage Traditional IRA and Roth IRA accounts to decide which is right for you.

To open an IRA with a JP. There are 2 types of IRAs. Chase IRA review for Roth IRA SEP Simple 401K traditional IRA and IRA rollover.

While both traditional and Roth IRAs are options the Roth variety often is preferable as it. Morgan Advisor can help you understand the benefits and disadvantages of each one. The process is easy as can be.

Chase You Invest Vs Robinhood 2021

Chase You Invest Vs Robinhood 2021

Chase Investment Account Review I Ve Now Had Chase You Invest For A Few Months Youtube

Chase Investment Account Review I Ve Now Had Chase You Invest For A Few Months Youtube

Chase Freedom Flex Credit Card Review Money Under 30

Chase Freedom Flex Credit Card Review Money Under 30

4 Strategies For Getting The Most Out Of Your Ira Learning And Insights Chase Com

4 Strategies For Getting The Most Out Of Your Ira Learning And Insights Chase Com

Chase Brokerage Accounts The Complete Guide For 2019 Careful Cents

Chase Brokerage Accounts The Complete Guide For 2019 Careful Cents

Chase Ira Accounts Rates Roth Bank Fees 2021

Chase Ira Accounts Rates Roth Bank Fees 2021

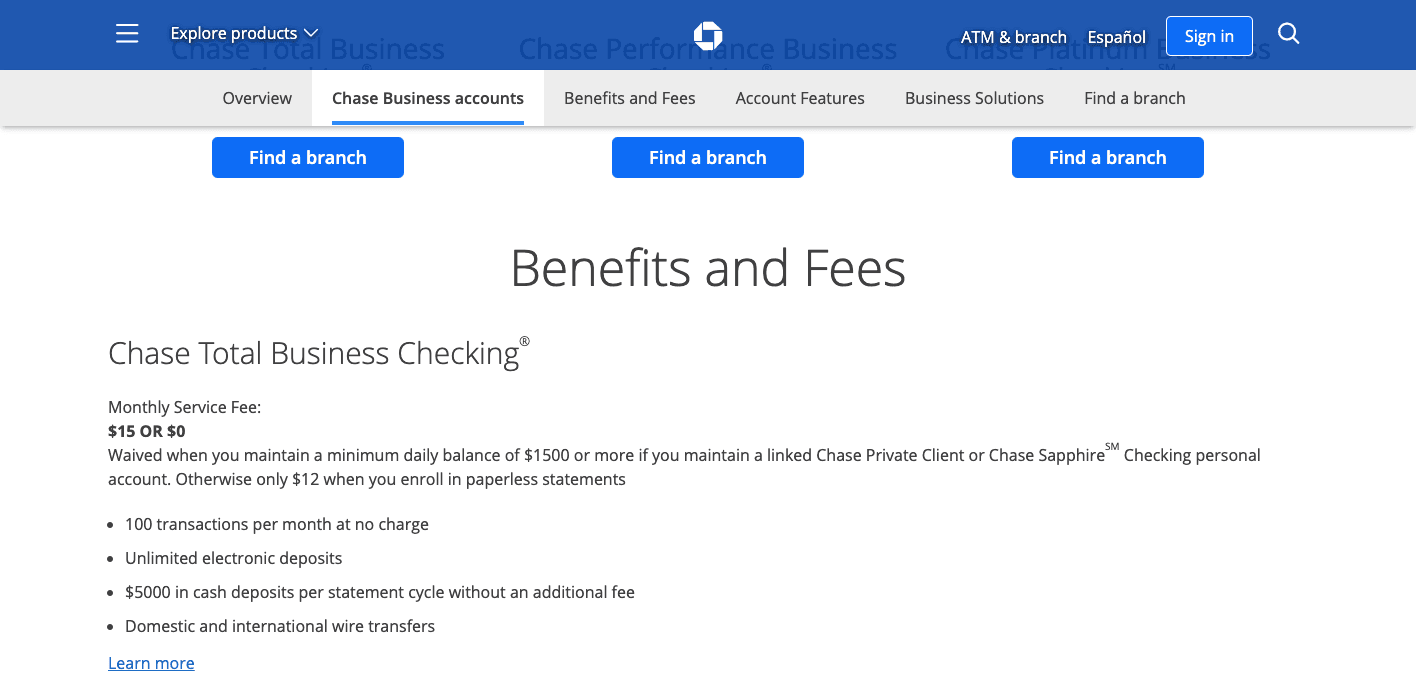

Chase Business Checking Review A Great Fit For Small Businesses

Chase Business Checking Review A Great Fit For Small Businesses

Chase You Invest Review 2021 Pros And Cons Uncovered

Chase You Invest Review 2021 Pros And Cons Uncovered

Determining Your Risk Tolerance Learning And Insights Chase Com

Determining Your Risk Tolerance Learning And Insights Chase Com

Chase You Invest Penny Stocks Fees Rules Otc Pink Sheets 2021

Chase You Invest Penny Stocks Fees Rules Otc Pink Sheets 2021

For 2021 Retirement Contribution Limits Are Mostly Unchanged What It Might Mean For You Learning And Insights Chase Com

For 2021 Retirement Contribution Limits Are Mostly Unchanged What It Might Mean For You Learning And Insights Chase Com

Chase You Invest App Review 2021 Commission Free Investing

Chase You Invest App Review 2021 Commission Free Investing

Chase Bank Statements Statement Template Bank Statement Business Letter Template

Chase Bank Statements Statement Template Bank Statement Business Letter Template

Chase You Invest Review My Experience Using You Invest

Chase You Invest Review My Experience Using You Invest

Https Www Chase Com Content Dam Chase Ux Documents Personal Investments You Invest You Invest Contributions To Your Ira Pdf

Fidelity Vs Chase You Invest 2021

Fidelity Vs Chase You Invest 2021

Roth Vs Traditional Iras What S The Difference Learning And Insights Chase Com

Roth Vs Traditional Iras What S The Difference Learning And Insights Chase Com

Vanguard Vs Chase You Invest 2021

Vanguard Vs Chase You Invest 2021

Post a Comment for "How To Start A Roth Ira Chase"