How To Open Roth Ira With Navy Federal

If youre age 50 or older you can make an additional 1000 catch-up contribution each year. Once funds have been deposited to the IRA Navy Federal will credit the bonus directly into your new IRA account within 30 days.

Primerica Roth Ira Review 2021

Primerica Roth Ira Review 2021

But you dont have to handle the process on your own.

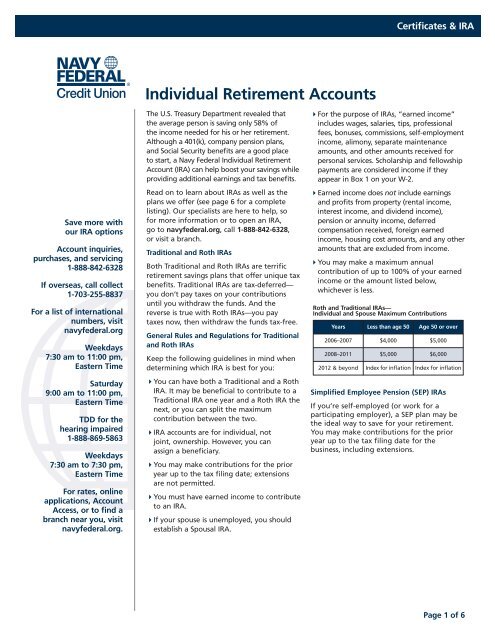

How to open roth ira with navy federal. The Roth IRA account is one of the very best financial accounts anyone can have. By completing and returning the forms you can establish a Roth IRA Savings Account Roth IRA Money Market Savings Account MMSA Roth Jumbo IRA MMSA or Roth IRA Certificate and begin saving for your retirement. This is a choice that federal government employees and US.

How To Deposit Money Into Roth IRA Navy Federal. Knowing how to open a Roth IRA starts with knowing your investing preferences. Navy federal Roth IRA percentage.

Navy federal Roth IRA percentage. Most large firms also offer online access to start the account application. SEP Simplified Employee Pension IRA.

You might be able to open a credit union Roth with as little as 25. We have an industry specialist with a lot of experience in the self-directed retirement field hes an IRA professional with a key strategy which is a self-directed IRA custodian. Currently weve been collaborating for many years currently and also I can attest a good deal of sector expertise.

While the benefits of membership in NFCU are significant it is important to note that membership in Navy Federal Credit Union is not open to everyone. If your bank doesnt offer Roth IRA accounts you can open one with a brokerage firm. You can put up to 5500 a year into your Roth IRA.

Its my pleasure to present Ben Barker from Accuplan so welcome Ben and also thanks for joining us today. If youre a do-it-yourself investor choose a brokerage. Enclosed are the documents necessary to open a Roth Individual Retirement Arrangement IRA at Navy Federal.

Talk to a financial advisor at Navy Federal Financial Group. NFCU is a union whose members are mainly drawn from the US military and specifically the Navy. Military professionals need to make when they consider choosing a retirement savings plan.

Members get to save money here take out loans and benefit from investment opportunities. One way to work toward that goal is to open an individual retirement account. Navy Federal Credit Union Account Features.

Navy Federal does not provide and is not responsible for the product service overall website content security or privacy policies on any external third-party sites. Interested in an investment account. With traditional and SEP IRAs you pay taxes when you withdraw money from the retirement plan.

Once the 50 required minimum balance has been deposited to the IRA Navy Federal will credit the bonus directly into the new IRA account within 45 days. Open a new IRA plan from Navy Federal Credit Union. Synchrony Bank offers Roth IRA CDs and traditional IRA CDs.

With a Roth IRA you pay taxes at the time you contribute but the eventual distribution is tax-free as long as you meet certain requirements. The Navy Federal Credit Union privacy and security policies do not apply to the linked site. Also with the ROTH IRA and TSP ROTH you have to have had the account open for longer than 5 years.

Deposit a minimum of 100 in the new IRA account no later than 45 days after account opening. You can open a Roth IRA at an online broker and then choose. Opening a Roth IRA can be as simple as visiting your banks website and filling out an online application.

Members who open their first IRA plan on 1102021 and fund their 50 minimum on 2152021 will receive the 50 bonus in their IRA account by 3302021. Membership at Navy Federal Credit Union is open to. Fill out the account opening paperwork in print or.

Remember with an IRA ROTH IRA and TSP ROTH you have to reach age 59 12 before you can withdraw those funds without penalty. When you open a Navy Federal Roth IRA. How to deposit money into Roth IRA navy federal.

Are there income limits to the ROTH. Our field of membership is open to the armed forces the DoD veterans and their families. Navy Federal Credit Union NFCU offers many financial products such as its Traditional IRA which can provide several advantages over those products offered by competing financial institutions.

But most people dont fully understand how the work or how to use them that will maximize their true long-term. The TSP ROTH is not subjected to income limitations for participants. Navy Federal Credit Union is offering a 100 bonus when you open any IRATraditional Roth or SEP.

Be sure to keep a copy for your records. Generally you can set up regular transfers to the Roth from another account. Navy Federal Roth IRA Percentage.

Open Now a Roth IRA account.

How Why To Open A Roth Ira For Your Kids Above The Canopy

How Why To Open A Roth Ira For Your Kids Above The Canopy

The Tax Trick That Could Get An Extra 56 000 Into Your Roth Ira Every Year Myra Personal Finance For Immigrants

The Tax Trick That Could Get An Extra 56 000 Into Your Roth Ira Every Year Myra Personal Finance For Immigrants

Usaa Ira Fees Rates Review Roth Traditional Ira Account 2021

Usaa Ira Fees Rates Review Roth Traditional Ira Account 2021

Budgeting 101 How To Create A Budget Follow Financialfitclub Financialplanner Financialfreedom Financialphysical Budgeting Budgeting 101 Making A Budget

Budgeting 101 How To Create A Budget Follow Financialfitclub Financialplanner Financialfreedom Financialphysical Budgeting Budgeting 101 Making A Budget

Individual Retirement Accounts Navy Federal Credit Union

Individual Retirement Accounts Navy Federal Credit Union

/iras-5bfc2fa646e0fb0051be974a.jpg) Are There Tax Penalties For Closing My Ira Account

Are There Tax Penalties For Closing My Ira Account

Best Places To Open A Roth Ira In 2021

Best Places To Open A Roth Ira In 2021

Disadvantages Of The Roth Ira Not All Is What It Seems

Disadvantages Of The Roth Ira Not All Is What It Seems

Can I Transfer My Roth Ira To My Roth Tsp Military Guide

Can I Transfer My Roth Ira To My Roth Tsp Military Guide

4 Reasons To Start Using A Roth Ira In 2018

4 Reasons To Start Using A Roth Ira In 2018

Roth Ira Rules And Contribution Limits For 2021

Roth Ira Rules And Contribution Limits For 2021

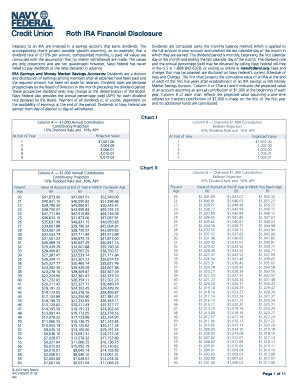

Fillable Online Navyfederal Roth Ira Financial Disclosure Navy Federal Credit Union Navyfederal Fax Email Print Pdffiller

Fillable Online Navyfederal Roth Ira Financial Disclosure Navy Federal Credit Union Navyfederal Fax Email Print Pdffiller

How To Start A Roth Ira And Select An Ira Custodian Cash Money Life

How To Start A Roth Ira And Select An Ira Custodian Cash Money Life

Understanding Your Ira Options Navy Federal Credit Union

Understanding Your Ira Options Navy Federal Credit Union

How To Setup An Automatic Roth Ira

How To Setup An Automatic Roth Ira

An Infographic Showing You The Ten Most Asked Money Questions That Readers Of Money Q A Life Insurance For Seniors This Or That Questions Life Insurance Policy

An Infographic Showing You The Ten Most Asked Money Questions That Readers Of Money Q A Life Insurance For Seniors This Or That Questions Life Insurance Policy

Ira Savings Accounts Navy Federal Credit Union

Post a Comment for "How To Open Roth Ira With Navy Federal"