Can You Open A Roth Ira With Robinhood

Lets say you want to start saving money for retirement. Roth IRA Contribution And Income Limits.

Robinhood Review 2021 Commission Free Trading App

Robinhood Review 2021 Commission Free Trading App

For a 0 commission IRA company see Ally Invest review.

Can you open a roth ira with robinhood. First of all the maximum contribution for 2021 is 6000 7000 if age 50 or older. Its even possible to open a Roth IRA on behalf of your infant as long as you can show the child is making earned income. You can open a Roth IRA even if you dont have earned income as long as your spouse does.

No I dont think you can. You fund your account and choose investments. To start with the owner of the Roth IRA should not.

If youd rather have someone pick an investment portfolio for you you can open your Roth IRA at a robo-advisor. Unfortunately Robinhood Financial does not offer any IRA accounts at this time. You cant open your own brokerage account.

If youre putting money into a Robinhood account this year and you havent already maxed out your Roth IRA contributions Im not really sure what youre doing reading Wealth Daily. This restriction is a legal requirement specific to the investment industry and theres no way around it. If youre aged 50 or older a catch-up provision allows you to put in an additional 1000 for a.

Stupid Name Smart Idea It may have a kind of silly name but a Roth IRA should be every investors best friend. Second of all there are limitations on who can contribute to a Roth IRA based on income. Before you start calling up the stock brokers weve reviewed here at Investor Junkie be aware that theres one basic problem with being a teenage investor.

In fact weve been waiting on this day because 2013 actually. As of 2019 you can contribute up to 6000 a year or 7000 a year if youre over 50 and can deduct part or all of that amount on your income taxes depending on your income. In order to do this you must file taxes jointly and your spouse must earn at least as much as you contribute to your Roth IRA and your spouses Roth IRA combined.

You cant connect separate brokerage accounts currently. There are a lot of investing apps that look perfect for teenagers hello Robinhood but you still need to be at least 18 years old to participate. Robinhood minimum amount to open.

And you can use Stock Advisor to pick the stocks that youre holding inside of your Roth IRA. All income limits still apply. For 2020 the maximum contribution to a Roth IRA is 6000 per yearBut if youre 50 or older that increases to 7000 per year.

There are no Traditional IRA Roth IRA SEP or SIMPLE retirement accounts at this broker. Every few years the limits surrounding Roth IRAs change. The IRS limit for both 2020 and 2021 is 6000 for both the traditional and the Roth IRA combined.

Robo-advisors are online services that build and maintain a diversified portfolio. And Vanguard has a higher minimum to get started than Im looking to do I think its like 3K to start a Roth. If you want Roth Id recommend going through a traditional broker and just letting an advisor shove it in some mutual fund and forget about it.

There is a bit of a. Robinhood minimum investment to open brokerage account. How Much Can You Put into a Roth IRA.

I use it for just playing around with a few dollars here and there but its not. If your goal is to get rich using Robinhood there are three steps youll need to take. Roth IRA owners who want to transfer their account to a new custodian can avoid taxes and penalties if they follow some relatively simple rules.

You do your research and decide that a Traditional IRA is right for you. If youre putting money into a Robinhood account this year and you havent already maxed out your Roth IRA contributions Im not really sure what youre doing reading Wealth Daily. Once you have your account open you can begin to make payments.

You could use your RobinHood account as a separate IRA but remember there are rules about IRAs you will need to understand in order to be effective. It is super easy to open a Bitcoin IRA so you can turbo-speed your retirement plan. How to Begin a cryptocurrency retirement plan The Best Way to Enter into Bitcoin Robinhood Roth Ira In 2021 big institutions began purchasing Bitcoin at astonishing levels.

Before you start investing make sure you study each stock you intend to buy. 3 Ways a Roth IRA Is a.

Robinhood Ira Account Fees Roth Ira Rates 2021

Robinhood Ira Account Fees Roth Ira Rates 2021

Transfer To Robinhood Account To From Fidelity 2021

Transfer To Robinhood Account To From Fidelity 2021

:max_bytes(150000):strip_icc()/Robinhoodvs.ETRADE-5c61c027c9e77c0001d930b3.png) Is Robinhood Safe For Investors

Is Robinhood Safe For Investors

Investing Is Not That Hard Investing Start Investing Robinhood App

Investing Is Not That Hard Investing Start Investing Robinhood App

How To Use Apps To Save Invest Investing Financial Motivation Investing Money

How To Use Apps To Save Invest Investing Financial Motivation Investing Money

Robinhood App Set Up Tutorial For Robinhood Get A Free Stock Youtube

Robinhood App Set Up Tutorial For Robinhood Get A Free Stock Youtube

Robinhood Get A Free Stock No Fees Ever Investing Easy Money How To Get

Robinhood Get A Free Stock No Fees Ever Investing Easy Money How To Get

I Maxed Out My Roth Ira With My Robinhood Profits Retirement 2020 Checked Youtube

I Maxed Out My Roth Ira With My Robinhood Profits Retirement 2020 Checked Youtube

This Post Is Part Of A Larger Attempt To Share My Personal Systems That Help Me Organize My Life I M No Expert B Where To Invest Ira Accounts Chase Freedom

This Post Is Part Of A Larger Attempt To Share My Personal Systems That Help Me Organize My Life I M No Expert B Where To Invest Ira Accounts Chase Freedom

Robinhood Investing With No Fee S You Get A Free Stock Investing Apps Trading Quotes Day Trading

Robinhood Investing With No Fee S You Get A Free Stock Investing Apps Trading Quotes Day Trading

The Best Traditional And Roth Ira Accounts Of 2019 Image For You Investing Apps Finance Investing

The Best Traditional And Roth Ira Accounts Of 2019 Image For You Investing Apps Finance Investing

Robinhood S Halted Foray Into Banking Prompts Lawmaker Scrutiny Online Stock Trading Investing Robinhood App

Robinhood S Halted Foray Into Banking Prompts Lawmaker Scrutiny Online Stock Trading Investing Robinhood App

Dividend Investing Robinhood Challenge For Monthly Passive Income Week 8 Cherry Tung Youtube Dividend Investing Investing Investing Books

Dividend Investing Robinhood Challenge For Monthly Passive Income Week 8 Cherry Tung Youtube Dividend Investing Investing Investing Books

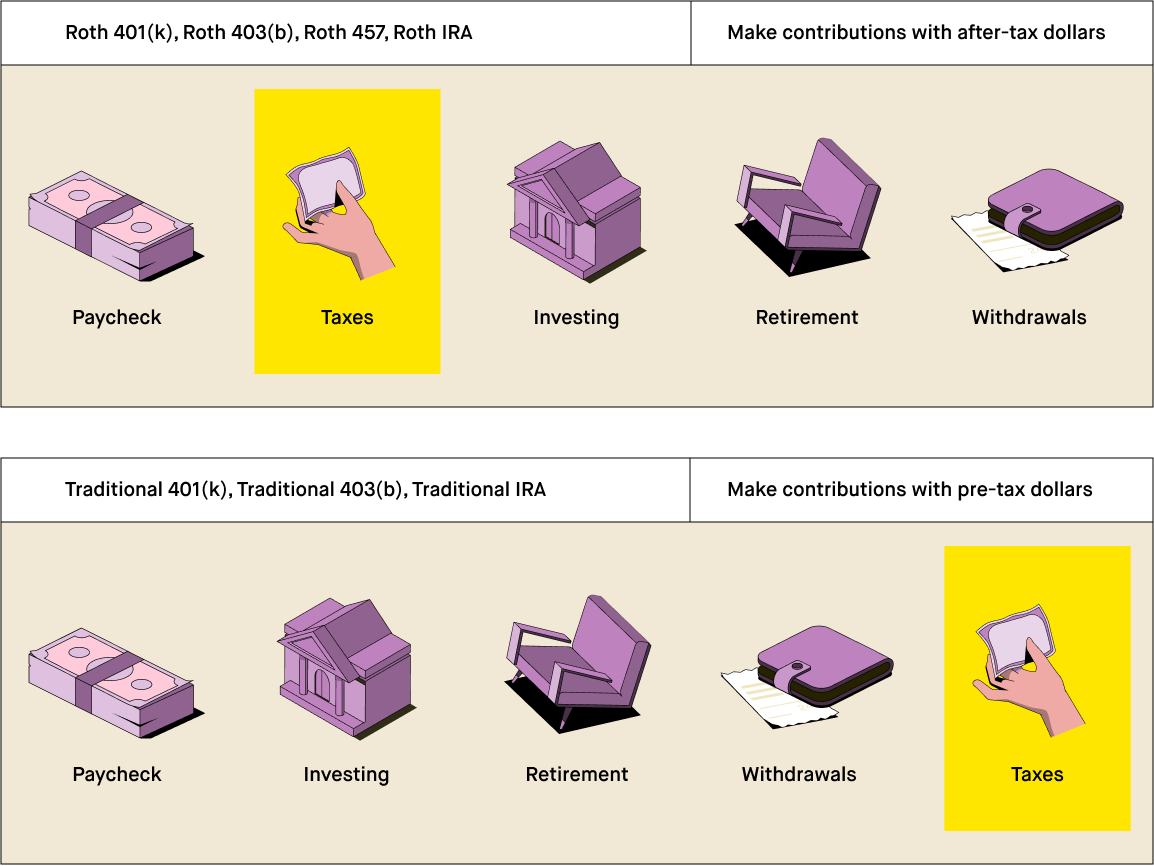

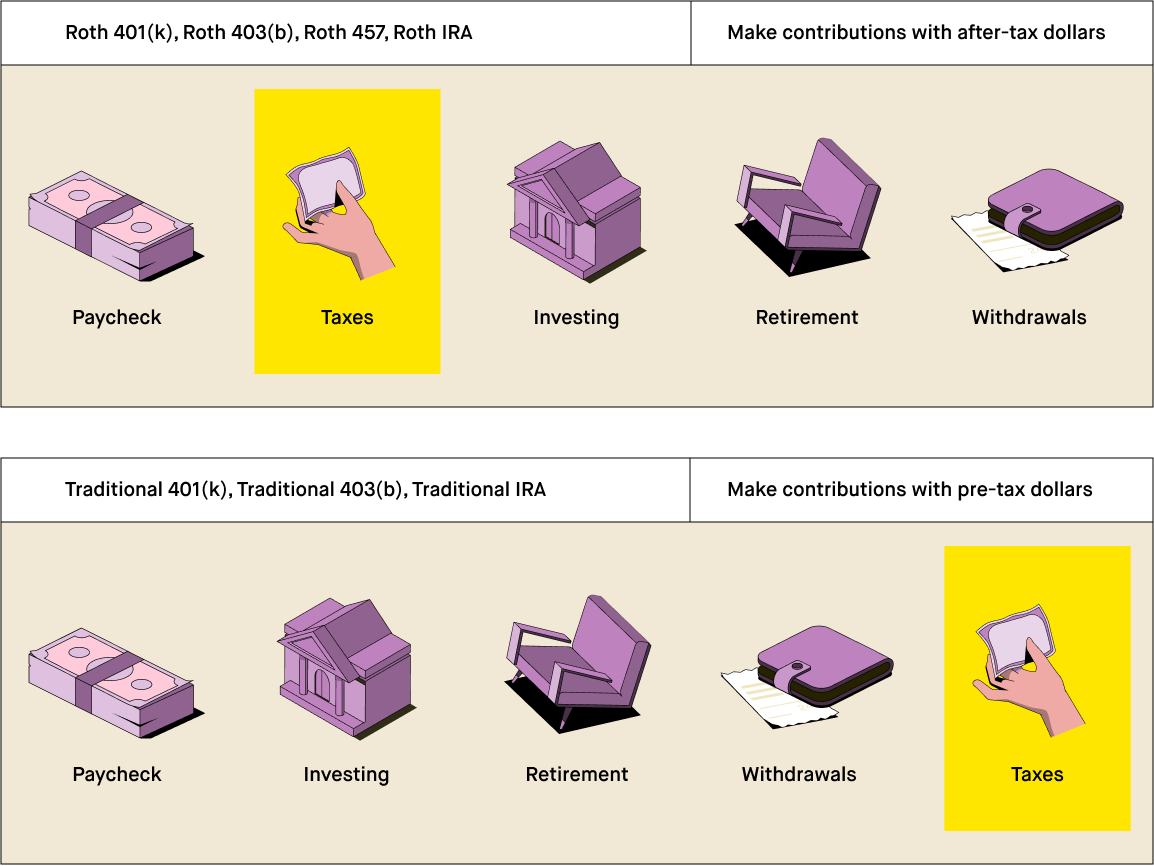

What Is A Roth 401 K 2020 Robinhood

What Is A Roth 401 K 2020 Robinhood

Roth Ira Vs Roth 401 K Money Saving Plan Finance Investing Retirement Savings Plan

Roth Ira Vs Roth 401 K Money Saving Plan Finance Investing Retirement Savings Plan

How To Get Started In Stocks With Robinhood Investing Apps Investing Money Real Estate Investing Quotes

How To Get Started In Stocks With Robinhood Investing Apps Investing Money Real Estate Investing Quotes

Best Online Stock Brokers In 2021 According To Readers Online Broker Stock Broker Online Stock

Best Online Stock Brokers In 2021 According To Readers Online Broker Stock Broker Online Stock

403 B Plan Vs Roth Ira Infographic Inside Your Ira Roth Ira Investing For Retirement Roth

403 B Plan Vs Roth Ira Infographic Inside Your Ira Roth Ira Investing For Retirement Roth

Is Robinhood Right For You With Images Investing Money Investing Online Broker

Is Robinhood Right For You With Images Investing Money Investing Online Broker

Post a Comment for "Can You Open A Roth Ira With Robinhood"