Should I Open A Roth Ira With Chase

However Chase requires 50000 in assets 100000 in some cases to open an IRA through this channel. This means you pay income taxes on the money going in.

Chase You Invest Review 2021 Pros And Cons Uncovered

Chase You Invest Review 2021 Pros And Cons Uncovered

Keep reading to learn about each of the options.

Should i open a roth ira with chase. However you wont face any taxes on eligible withdrawals. Chase typically charges anywhere from 13 to 15 in assets under management for traditionally-managed accounts. Now the question is where should I start my Roth IRA.

When it comes to choosing a Roth vs traditional IRA consider this general rule of thumb. 15K from my Chase savings account to new Roth IRA. Individual Retirement Accounts with Chase If youre searching for a low-cost IRA Chase may have an answer for you.

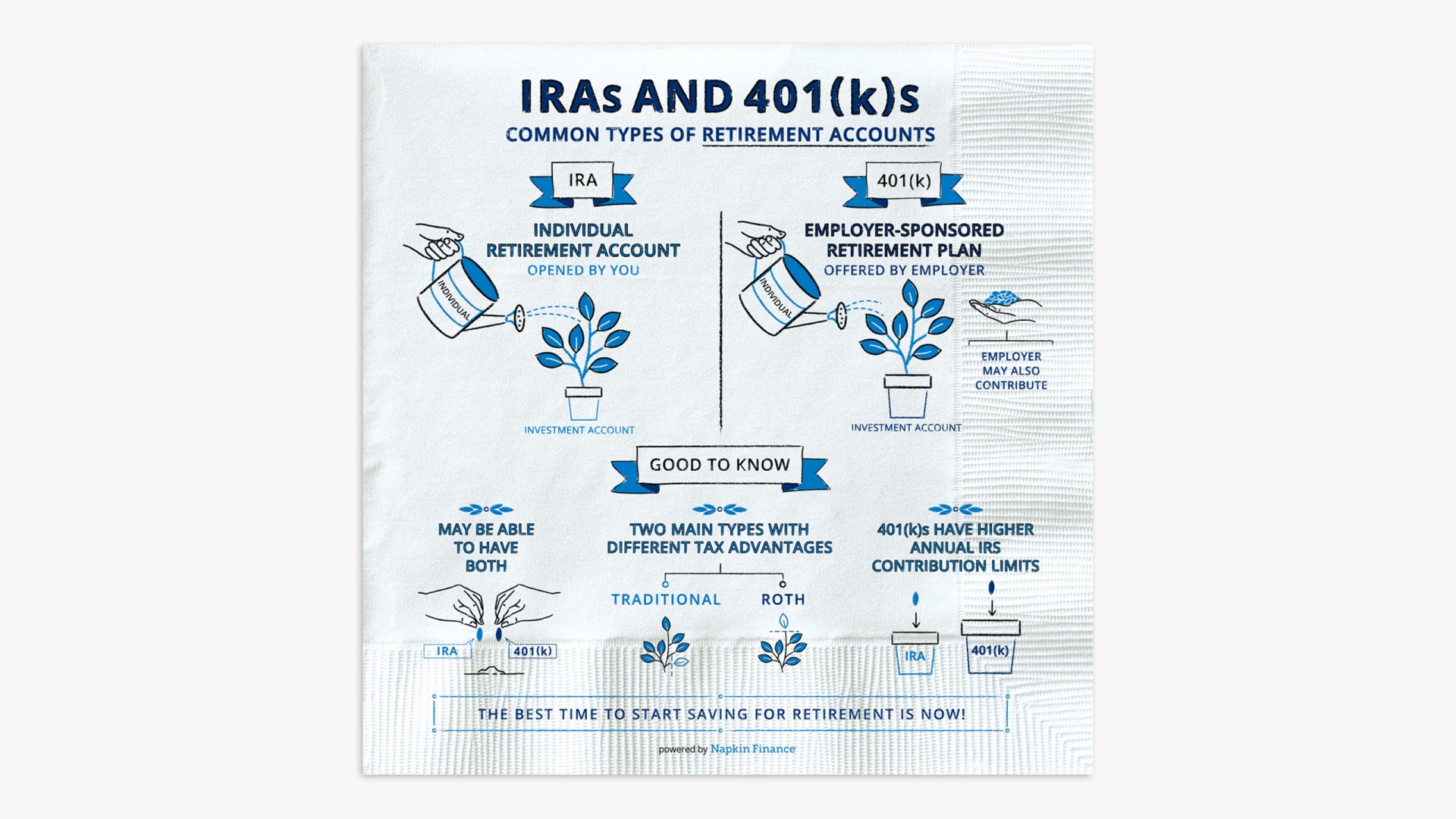

An individual retirement account IRA is a tax-advantaged account that individuals use to save and invest for retirement. Opening a Roth IRA can be as simple as visiting your banks website and filling out an online application. Here are the details.

Chase IRA account rates bank fees pros and cons. Traditional IRA and Roth IRA accounts to decide which is right for you. No minimum to start.

While theres a Roth IRA maximum contribution amount theres no minimum according to IRS rules. Although there is no age limit to open a Roth IRA there are income and contribution limits that investors should be aware of before opening and funding a Roth IRA. You have until April 15 2021 to make IRA contributions for tax year 2020.

Open a brokerage account IRA or start a managed portfolio monitored by our experts. The folder can contain multiple investments with multiple companies but you cant put more than 6000 per year into the folder. Additionally if they offer an employer match you should contribute at least that much to your retirement account.

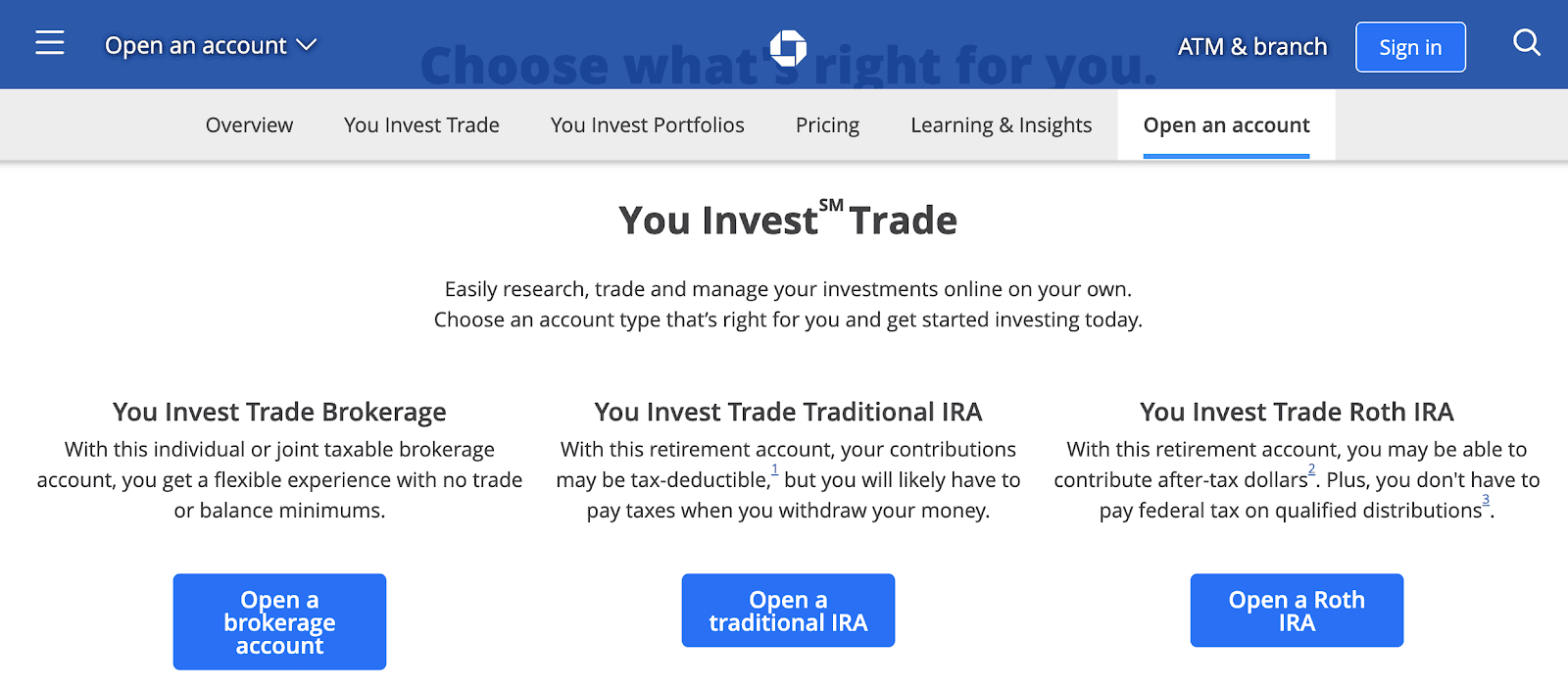

The Roth IRA allows workers to contribute to a tax-advantaged account let the money grow tax-free and never pay taxes again on withdrawals. With its new brokerage firm You Invest you can open a retirement account with almost no fees at all. So if you wanted you could buy a stock of Tesla and have it grow tax-free in your Roth IRA account.

Roth IRA This individual retirement account is meant to build retirement savings which can then be withdrawn after you reach 59½. In 2020 as long as your gross income is less than 124000 for single filers and 196000 for married couples filing jointly you can contribute the maximum amount into a Roth IRA. This option comes with a one-on-one working relationship with a traditional human advisor.

A Roth IRA is a retirement-savings plan that allows you to invest with after-tax dollars. Why You Shouldnt Open Your Roth IRA at a Bank Many banks including Bank of America Wells Fargo and Chase offer Roth IRA accounts. Money going into a Roth IRA has already been taxed.

The good news is that the IRS doesnt require a minimum amount to open a Roth IRA. But an online broker is generally a better option for your Roth. What is a Roth IRA.

You can begin taking tax-free distributions once you reach age 595 as long as youve had your Roth IRA open for at least five years. Whether youre contemplating opening a Roth IRA or you already have one in place there are five things you need to know to make the account work for you the way it should. Open an account for roth IRA through online trade.

JPMorgan Chase and its affiliates do not provide tax legal or accounting advice. If you think youll be in a higher tax bracket when you retire than you are today go with a Roth IRA. At your ages you can each contribute up to 6000 to a traditional IRA a Roth IRA or any combination of the two you.

When Not to Open a Roth IRA. A Roth IRA offers many benefits to retirement savers. Forgoing the Roth Due to Taxes.

If eligible contribute after-tax dollars now and get tax-free withdrawals on qualified distributions later. So as far as I understand it you can think of your Roth IRA as a folder on your desktop. I am considering a Vanguard Roth IRA because futureadvisor suggests switching to some Vanguard ETFs which would be free with a Vanguard account and the fees to buy the other ETFs for example from Schwab seem to be not that high either.

JPMorgan Chase and its affiliates do not provide tax legal or accounting advice. Chase IRA Fees and Commissions You Invest Trade is Chases self-directed brokerage service. Also this option will cost you more.

How to Start a Roth IRA. This material has been prepared for informational purposes only and is not intended to provide and should not be relied on for tax legal or accounting advice. Chase IRA review for Roth IRA SEP Simple 401K traditional IRA and IRA rollover.

In addition to your IRA you should open a retirement account with your employer if they offer one such as a 401k. The investment gains and withdrawals are tax-free. You can open several different types of accounts using You Invest.

What Are Iras And 401 K S Learning And Insights Chase Com

What Are Iras And 401 K S Learning And Insights Chase Com

Https Www Chase Com Content Dam Chase Ux Documents Personal Investments You Invest You Invest Contributions To Your Ira Pdf

Chase You Invest App Review 2021 Commission Free Investing

Chase You Invest App Review 2021 Commission Free Investing

Chase You Invest Review My Experience Using You Invest

Chase You Invest Review My Experience Using You Invest

Roth Vs Traditional Iras What S The Difference Learning And Insights Chase Com

Roth Vs Traditional Iras What S The Difference Learning And Insights Chase Com

For 2021 Retirement Contribution Limits Are Mostly Unchanged What It Might Mean For You Learning And Insights Chase Com

For 2021 Retirement Contribution Limits Are Mostly Unchanged What It Might Mean For You Learning And Insights Chase Com

Chase You Invest Review What S Good And Bad About It

Chase You Invest Review What S Good And Bad About It

Chase Brokerage Accounts The Complete Guide For 2019 Careful Cents

Chase Brokerage Accounts The Complete Guide For 2019 Careful Cents

Fidelity Vs Chase You Invest 2021

Fidelity Vs Chase You Invest 2021

Chase You Invest Review 2020 Millennial Money

Chase You Invest Review 2020 Millennial Money

Chase You Invest Vs Robinhood 2021

Chase You Invest Vs Robinhood 2021

Determining Your Risk Tolerance Learning And Insights Chase Com

Determining Your Risk Tolerance Learning And Insights Chase Com

Which Should I Save For First My Retirement Or My Child S College Education Learning And Insights Chase Com

Which Should I Save For First My Retirement Or My Child S College Education Learning And Insights Chase Com

4 Strategies For Getting The Most Out Of Your Ira Learning And Insights Chase Com

4 Strategies For Getting The Most Out Of Your Ira Learning And Insights Chase Com

Chase You Invest Review 2021 Trade Vs Portfolios Finder Com

Chase You Invest Review 2021 Trade Vs Portfolios Finder Com

Chase Ira Accounts Rates Roth Bank Fees 2021

Chase Ira Accounts Rates Roth Bank Fees 2021

Merrill Edge Vs Chase You Invest 2021

Merrill Edge Vs Chase You Invest 2021

Post a Comment for "Should I Open A Roth Ira With Chase"