How Much Money Do I Need To Open A Roth Ira With Vanguard

But to open a Roth and contribute to it you need to be below the Roth IRA income limits. For the 2019 tax year the Roth IRA allows you to contribute up to 6000 if youre under the age of 50 or 7000 if youre over the age of 50.

Vanguard Investment Tutorial Investing Roth Ira Investing Ira Investment

Vanguard Investment Tutorial Investing Roth Ira Investing Ira Investment

You do not need an employer to open an IRA for you.

How much money do i need to open a roth ira with vanguard. There are limits to how much money you can put into IRAs each year. The annual contribution limit to both traditional and Roth IRAs is 6000 for 2020 and 2021. 1000 for Vanguard Target Retirement Funds and Vanguard STAR Fund.

Can I open a Roth IRA with Vanguard. The contribution limit is 6000 for 2020 or 100 of earned income whichever is less. After entering the necessary banking information the next step is determining the initial contribution amount for your Roth IRA account note that the screenshot shows a maximum of 6500 because the limit in 2018 was 5500 plus there is an additional 1000 contribution amount available if youre over 55.

If it sounds. Workers age 49 and younger can contribute up to 6000 to a Roth IRA in 2021. Those with incomes between 124000 and 138999 can contribute a reduced amount.

How much money do you need to retire comfortably. In order to move the money out of your 401k account youll need to have an account opened for that money to move into. The minimum amount for a Vanguard IRA depends on what types of investments you want to make.

For 2020 you can invest 6000 in either a traditional IRA or a Roth IRA. Though there are a few types of IRAs that employers can offer for employees you can set up the most common IRA account types traditional and. There are few restrictions on who can open a Vanguard account.

As the name. The following minimums apply to individual and joint accounts Roth and traditional IRAs UGMAUTMA accounts and most other account types. Great skip this step.

So if your child only makes 2000 in a year then they can only put 2000 into the Roth IRA. With a traditional IRA the rules are as follows. Since you fund your account with after-tax income when you withdraw money from your account in your golden years you dont have to pay federal taxes on that money.

For Vanguard exchange-traded funds the minimum amount necessary is the value of a single share. An IRA an IRA is an individual retirement account. Another way that a Roth IRA differs from a 401k or a 403b is the roth aspect of the account.

As long as you dont exceed the IRSs income limits you can still contribute the maximum annual amount to a Roth IRA. If youre 50 or older and need to catch up you can add an extra 1000 for a total of 7000. Those age 50 and older can make an additional 1000 catch-up contribution for a maximum possible Roth IRA deposit of.

Those with incomes over 139000 cannot contribute. Single full contribution up to 124000 partial contribution up to 139000 after which no. And if youre age 50 or older you can save up to 7000 for 2020 and 2021.

Who can open a Roth IRA. For the 2020 and 2021 tax years thats 6000 or 7000 if youre age 50 or older. The current income limits beyond which you can no longer make a Roth IRA contribution are as follows.

Consider maximizing your contributions each year up to 6000 for 2020 and 2021. Some mutual funds have a 1000 or higher minimum investment though once you make. In 2020 contributions from individuals with single tax-filing status cannot be made to a Roth if your income exceeds 139000 and in 2021 income cant exceed 140000.

How much can you contribute to a Roth IRA. 1 Theres also a limit on who can contribute to a Roth IRA based on your income. Get details on IRA contribution limits deadlines No taxes for your beneficiaries.

Starting in 2020 as long as you are still working there is no age limit to be able to contribute to a Traditional IRA. Single tax filers can contribute the full amount to a Roth IRA provided their modified adjusted gross income MAGI is below 124000. That means that your money grows tax free.

One common rule is that youll need between 70 to 80 of your pre-retirement income per annum. Already have an IRA open at Vanguard. If youve decided to move your funds to Vanguard you have two main options.

1 Roth IRA. Individuals aged 50 and over can deposit a catch-up contribution in the amount of 1000. 2 This too isnt a fee but youll need enough money to buy whatever investments you want in your Roth IRA.

Keep in mind that you have from January 1st until April 15th of the following year to be able to contribute that amount. 3000 for most actively managed Vanguard funds Most Vanguard index funds are now available in lower-cost Admiral.

Vanguard 101 Automatic Investments Fly To Fi

Vanguard 101 Automatic Investments Fly To Fi

How To Convert A Roth Ira At Vanguard An Illustrated Tutorial

How To Convert A Roth Ira At Vanguard An Illustrated Tutorial

Backdoor Roth Ira Step By Step With Vanguard Bravopolicy

Backdoor Roth Ira Step By Step With Vanguard Bravopolicy

Vanguard Roth Ira Account Opening Review Pt Money

Vanguard Roth Ira Account Opening Review Pt Money

Backdoor Roth Ira Ultimate Guide And Tutorial

Backdoor Roth Ira Ultimate Guide And Tutorial

My Experience Opening Up A Vanguard Roth Ira Financial Product Reviews

The 7 Best Roth Ira Accounts Of 2021 Money

The 7 Best Roth Ira Accounts Of 2021 Money

/Vanguardvs.Fidelity-5c61b9cfc9e77c0001d321d4.png) Vanguard Vs Fidelity Investments

Vanguard Vs Fidelity Investments

How To Buy Vanguard Index Funds In 2021 Benzinga

How To Buy Vanguard Index Funds In 2021 Benzinga

How To Invest Vanguard Roth Ira For Beginners 2019 Tax Free Millionaire Youtube

How To Invest Vanguard Roth Ira For Beginners 2019 Tax Free Millionaire Youtube

How To Start A Roth Or Traditional Ira How Much Does It Cost

How To Start A Roth Or Traditional Ira How Much Does It Cost

How To Roll Over Your Roth Ira From Betterment To Vanguard And Why I Did It Financial Panther

How To Roll Over Your Roth Ira From Betterment To Vanguard And Why I Did It Financial Panther

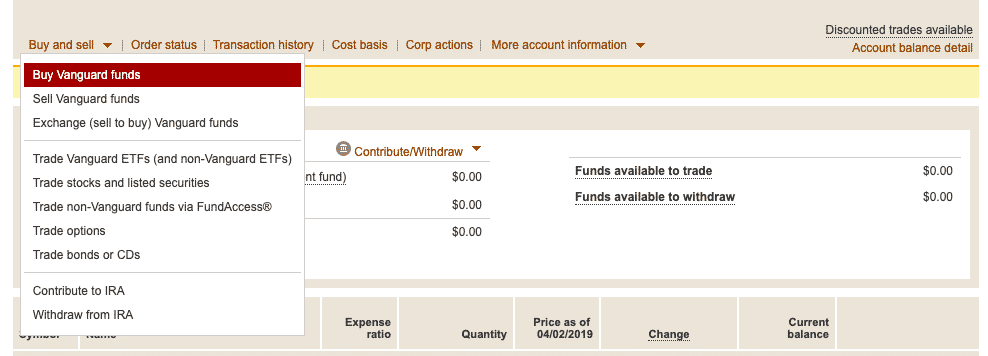

How Do I Buy A Vanguard Mutual Fund Online Vanguard

How Do I Buy A Vanguard Mutual Fund Online Vanguard

Step By Step Guide To Opening A Vanguard Roth Ira Biglaw Investor

Step By Step Guide To Opening A Vanguard Roth Ira Biglaw Investor

How To Open A Roth Ira With Vanguard Easy Guide Retirement Planning Why Vanguard Youtube

How To Open A Roth Ira With Vanguard Easy Guide Retirement Planning Why Vanguard Youtube

Backdoor Roth Ira 2020 Step By Step Guide With Vanguard Physician On Fire Roth Ira Roth Step Guide

Backdoor Roth Ira 2020 Step By Step Guide With Vanguard Physician On Fire Roth Ira Roth Step Guide

/CharlesSchwabvs.Vanguard-5c61ba4646e0fb00014426ee.png)

Post a Comment for "How Much Money Do I Need To Open A Roth Ira With Vanguard"