How To Open A Roth Ira With Etrade

A spousal IRA is simply an. Once the assets are at ETRADE convert the Traditional IRA to the Roth IRA online or call anytime for assistance.

How To Fund A Backdoor Roth Ira Smart Money Md

How To Fund A Backdoor Roth Ira Smart Money Md

Contributing often to your Roth IRA is critical to meeting your retirement goals.

How to open a roth ira with etrade. Its really easy to open a Roth IRA account. A Traditional Rollover or Roth IRA account must first be opened with ETRADE unless account assets will be rolled over into an existing IRA. Create a new Etrade account or use your existing one.

E-Trades IRA products including the Roth IRA do not require a minimum deposit at opening or a minimum amount to be maintained. Automate your retirement investing with Core Portfolios low 500 minimum. Contact the benefits administrator of the former employer and complete all distribution forms required to initiate the direct rollover.

Open a Roth IRA with us today. Enjoy fast easy withdrawals at age 59½ with free cash. Make tax-deductible contributions depending on income 2.

Use the IRA Selector tool to see if you qualify for a Traditional or a Roth IRA. Here are five things to know before you start helping your kid save for their retirement. Click Here to Begin The Roth IRA Application.

Furthermore customers who wish to invest through their automated managed portfolio services require a 5000 minimum deposit. Contribute on an after-tax basis and make qualified withdrawals at any time. At the end of the Traditional IRA application make the request to transfer an existing IRA to a new ETRADE Traditional IRA.

After logging onto ETrade the upper right corner of the website should have an option to Open Account. Open Account on the upper right hand corner of page. 2021 Etrade minimum investment to open brokerage account ROTH IRA.

You are allowed maximum yearly contributions of 5500 if you are under 50 years old and 6500 if you. Open both a Traditional IRA and a Roth IRA with ETRADE. All investment earnings are tax-deferred.

A Roth indeed makes sense at certain points in your life. Get an early start on retirement savings for your child with ETRADE. Use the IRA Selector tool to see if you qualify for a Traditional or a Roth IRA.

A nonworking spouse can open a traditional IRA or a Roth but only if he or she qualifies. Fidelity for Opening an IRA Picking a brokerage for an IRA is about more than just commissions or trading platforms. You can open a Roth IRA at an online broker and then choose your own investments.

Click that and you will get a list of accounts to open. Withdraw contributions at any time tax-free and penalty. Potential for tax-deferred growth.

However E-Trade trading accounts require at least a 500 deposit to open them. Click the Apply Now button on the right hand side. Opening a Roth IRA for kids under 18 is allowed but there are certain rules you have to follow.

At others however the traditional version of the IRA or 401k has a strong allure as well. Feb 14 2019 Opening a Roth IRA is a smart way to supercharge your retirement retirement investors will find a lot to love with E-Trades IRA offering An ETRADE Roth IRA lets you invest your way. The application process takes around 5 to 10 minutes.

Pay taxes only when distributions are taken. See this page for income and other limits for both types of IRAs. Our Roth IRA lets you withdraw contributions tax-free at any time.

Start saving for tomorrow today. This may be simpler than you think you can build a diversified portfolio with just three or four mutual funds. After opening the Roth IRA ETRADE will have you fund the account and choose a selection of investments.

Today were showing you how easy it is to open a Roth IRA at ETrade. Etrade minimum balance initial deposit amount requirement. Fill out step 2 of the application with your personal information.

Heres how ETrade and Fidelity compare on features for retirement. Contribute regularly to the account. ETRADE offers both traditional and Roth IRA for kids.

For more information including a full review check out. You will need to fill out your personal information. How to Open Etrade Roth IRA.

Enjoy fast easy withdrawals at age 59½ with free cash management features 3. Automate your retirement investing with Core Portfolios low 500 minimum.

Automatic Investing With Etrade Fintasks Vs Etrade Fintasks

Automatic Investing With Etrade Fintasks Vs Etrade Fintasks

Etrade Roth Ira Simple Guide To Starting A Roth Ira Account For Your Retirement Debt2riches

Etrade Roth Ira Simple Guide To Starting A Roth Ira Account For Your Retirement Debt2riches

Etrade Ira Review Roth Rollover Simple Account Fees 2021

Etrade Ira Review Roth Rollover Simple Account Fees 2021

To How Roth A Backdoor Up Etrade Set Ira

To How Roth A Backdoor Up Etrade Set Ira

Etrade Vs Wellstrade Wells Fargo 2021

Etrade Vs Wellstrade Wells Fargo 2021

Investment Choices Understanding Types Of Investments E Trade

Investment Choices Understanding Types Of Investments E Trade

Understanding Iras For Minors Learn More E Trade

Understanding Iras For Minors Learn More E Trade

Invest In Futures Online Futures Trading E Trade

Invest In Futures Online Futures Trading E Trade

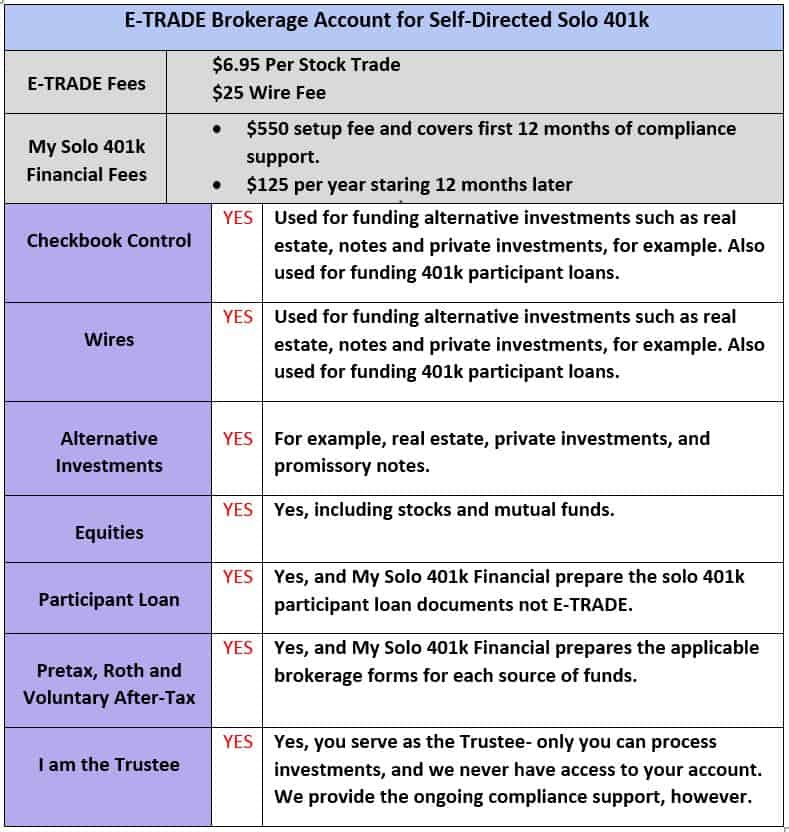

Etrade Solo 401k Brokerage Account From My Solo 401k Financial

Etrade Solo 401k Brokerage Account From My Solo 401k Financial

E Trade Core Portfolios Review 2021 Pros Cons And How It Compares Nerdwallet

E Trade Core Portfolios Review 2021 Pros Cons And How It Compares Nerdwallet

How To Do A Backdoor Roth Ira Using E Trade Youtube

How To Do A Backdoor Roth Ira Using E Trade Youtube

Understanding Ira Rollovers Learn More

Understanding Ira Rollovers Learn More

Transfer An Etrade Account To Td Ameritrade 2021

Transfer An Etrade Account To Td Ameritrade 2021

What Are Small Business Retirement Plans Learn More

What Are Small Business Retirement Plans Learn More

How To Open An E Trade Ira And Brokerage Account For New Investors Youtube

How To Open An E Trade Ira And Brokerage Account For New Investors Youtube

How To Open A Sep Ira Account With Etrade Youtube

How To Open A Sep Ira Account With Etrade Youtube

/CharlesSchwabvs.ETRADE-5c61bbd646e0fb0001587a71.png)

Post a Comment for "How To Open A Roth Ira With Etrade"