How To Open A Roth Ira On Fidelity

Open a Fidelity Account First we want to register an account with Fidelity youll need your name SSN DoB etc. Set up account features and preferences such as whether you want to receive financial documents electronically.

Fund Your Account Optional.

How to open a roth ira on fidelity. IRA distributions before age 59½ may also be subject to a 10 penalty. To begin this Backdoor Roth tutorial first off you need to open a Traditional IRA and Roth account with whatever mutual fund company you have. Age 59½ disability qualified first-time home purchase or death.

Open a Fidelity IRA. Knowing how to open a Roth IRA starts with knowing your investing preferences. This account can be opened and managed by any adultparent grandparent aunt uncle family friendon behalf of a minor earning income.

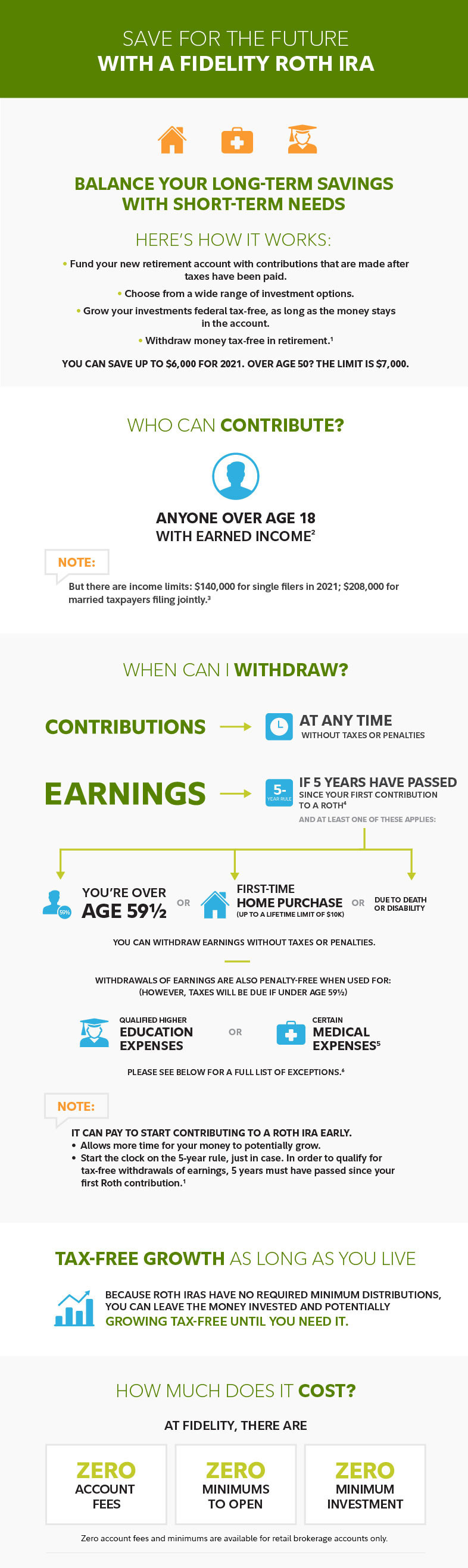

Review your selections the customer agreement and the terms and conditions. There are several IRA types available at Fidelity. Our IRAs have no account fees or minimums to open 1 and commission-free trades.

You can read our full Fidelity review here. Grow your savings and enjoy tax-free retirement withdrawals with a Roth IRA. Thus far I think Im doing well on my Roth IRA.

These include Roth Traditional Rollover SEP SIMPLE Inherited and Minor accounts. For a regular brokerage account Fidelity requires a minimum opening deposit of 2500. 1 Trading fees 2 0 commission for online US stock ETF and option trades.

If youre a do-it-yourself investor choose a brokerage. The Roth IRA account is one of the very best financial accounts anyone can have. 2 If you havent done so already open a Fidelity traditional rollover or Roth IRA.

This is my first complete Fidelity guide for beginners. Select Open an Account. Fund your account.

Open a Roth IRA from the 1 IRA Provider Fidelity. We need to verify your identity to open an account. Fidelity Roth IRA for Kids Help a child invest for the future.

Today were going to show you how to open a Roth IRA at Fidelity and why Fidelity is our favorite online broker. But for a retirement account there is no minimum required. With a Roth IRA you contribute money thats already been taxed that is after-tax dollars.

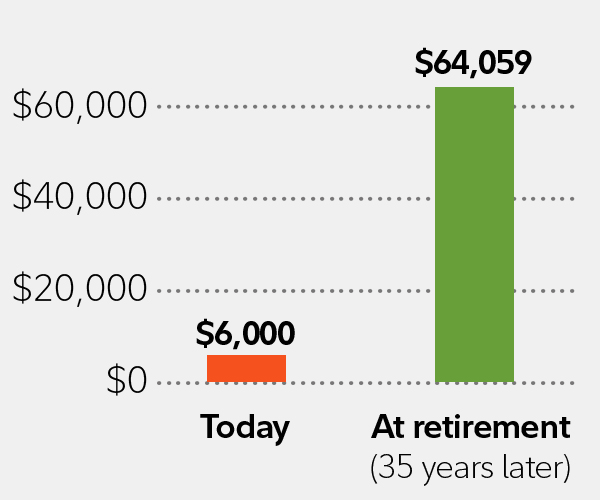

Any earnings in a Roth IRA have the potential to grow tax-free as long as they stay in the account. A Roth individual retirement account or IRA is one of the best places to save for retirement you put money in after paying income taxes on it but then your account grows entirely tax-free. Its quick and easy.

Fidelity and Vanguard are one of the more popular choices. Fidelity full and partial account transfers are free. Choose Open Now under Roth IRA.

You can open a Roth IRA at an online broker and then choose. Thats because the longer the timeline the greater the benefit of tax-free earnings. Withdrawals of earnings from Roth IRAs are federal income tax-free and penalty-free if a 5-year aging period has been met and the account owner is age.

Once you make a Fidelity account it should look something like this. But most people dont fully understand how the work or how to use them that will maximize their true long-term. Let me know your questions down below.

Make your first contribution. Yes there are no income limits on conversion. You can open a Roth IRA for a child who has taxable earned income 4.

Once youve opened your account there are several ways to fund it. Enter your personal information. Also if you andor your spouse have high income levels and are not eligible to contribute directly to a Roth IRA and you do not already have a traditional IRA you may want to consider opening a traditional IRA and making a nondeductible contribution then converting it to a Roth IRA.

A distribution from a Roth IRA is tax-free and penalty-free provided the 5-year aging requirement has been satisfied and one of the following conditions is met. Helping a young person fund an IRAespecially a Roth IRAcan be a great way to give them a head start on saving for retirement. There are no opening closing or annual fees for Fidelitys traditional Roth SEP SIMPLE and rollover IRAs.

Where To Open A Roth Ira The 5 Best Places For Beginners Rose Shafa

Where To Open A Roth Ira The 5 Best Places For Beginners Rose Shafa

Save For The Future With A Roth Ira Fidelity

Save For The Future With A Roth Ira Fidelity

How To Open A Roth Ira Fidelity Roth Ira Tutorial Youtube

How To Open A Roth Ira Fidelity Roth Ira Tutorial Youtube

Fidelity Ira Account Roth Rollover Traditional 2021

Fidelity Ira Account Roth Rollover Traditional 2021

How To Open A Fidelity Roth Ira Bank Account In 10 Minutes 2021l Youtube

How To Open A Fidelity Roth Ira Bank Account In 10 Minutes 2021l Youtube

Contributing To Your Ira Fidelity

Contributing To Your Ira Fidelity

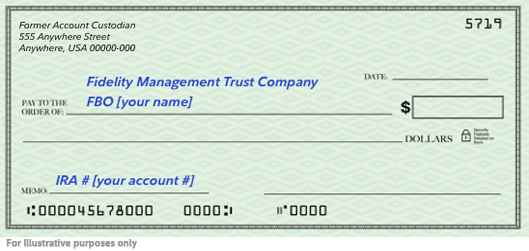

Backdoor Roth Ira Ultimate Fidelity Step By Step Guide Fatroth

How To Open A Roth Ira With Fidelity Youtube

How To Open A Roth Ira With Fidelity Youtube

Ira Transfer Moving Your Ira Fidelity

Ira Transfer Moving Your Ira Fidelity

How To Invest Your Ira Fidelity

How To Invest Your Ira Fidelity

/CharlesSchwabvs.Fidelity-5c61bb5f46e0fb00017dd690.png) Charles Schwab Vs Fidelity Investments

Charles Schwab Vs Fidelity Investments

The Backdoor Roth Tutorial With Fidelity

The Backdoor Roth Tutorial With Fidelity

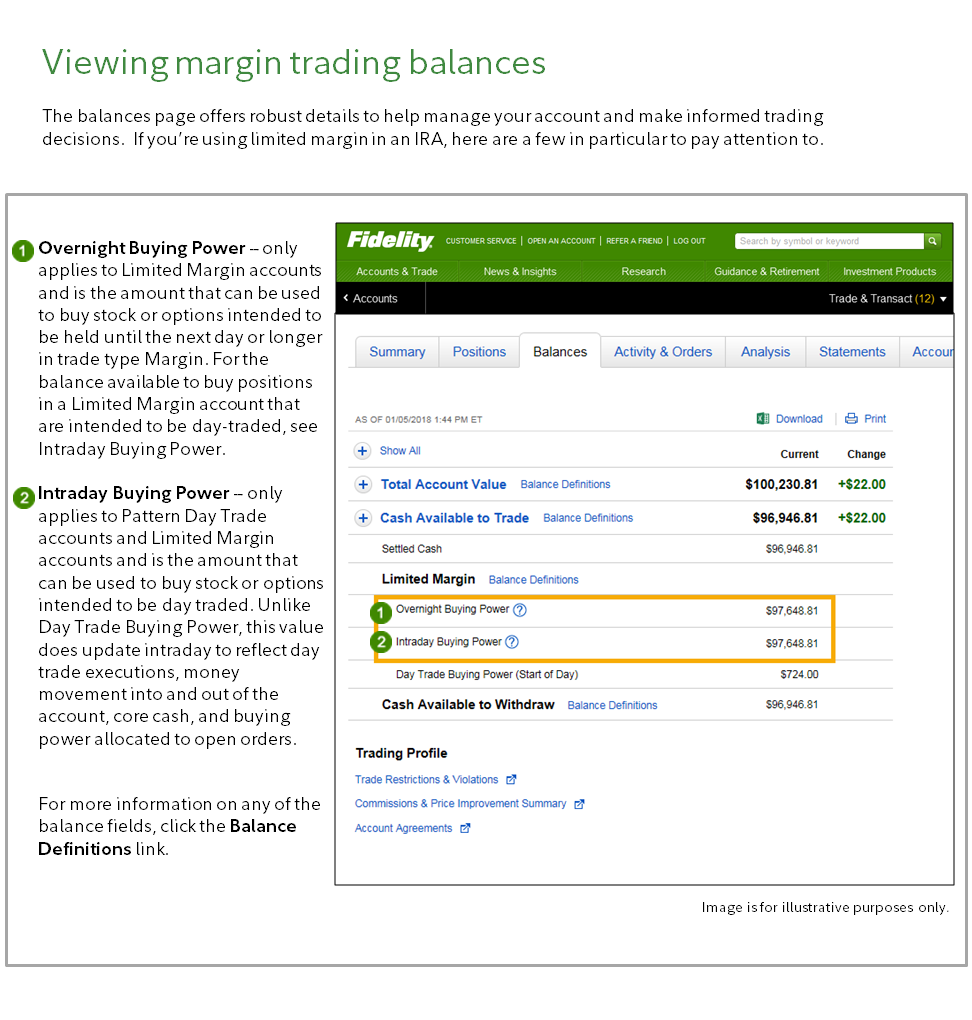

What Is Limited Margin Trading Fidelity

What Is Limited Margin Trading Fidelity

How To Open A Brokerage Account Roth Ira Fidelity Example Youtube

How To Open A Brokerage Account Roth Ira Fidelity Example Youtube

What Is A Roth Ira And Do You Really Need One Adopting A Lifestyle Roth Ira Roth Ira Investing Investing

What Is A Roth Ira And Do You Really Need One Adopting A Lifestyle Roth Ira Roth Ira Investing Investing

Step By Step Tutorial Of The Mega Backdoor Roth Through Fidelity Investments Cerebral Tax Advisors

Step By Step Tutorial Of The Mega Backdoor Roth Through Fidelity Investments Cerebral Tax Advisors

Converting Ira To Roth Ira Fidelity

Converting Ira To Roth Ira Fidelity

How To Open A Fidelity Roth Ira A Step By Step Guide Simplernerd

How To Open A Fidelity Roth Ira A Step By Step Guide Simplernerd

Post a Comment for "How To Open A Roth Ira On Fidelity"