Can A Foreigner Open Roth Ira

However minors typically cant open a brokerage account so youll need to open a custodial Roth IRA on their behalf. An IRA account is in effect a trust.

Roth Ira Vs 401 K Which Is Better For You Roth Ira Roth Ira Investing 401k Vs Roth Ira

Roth Ira Vs 401 K Which Is Better For You Roth Ira Roth Ira Investing 401k Vs Roth Ira

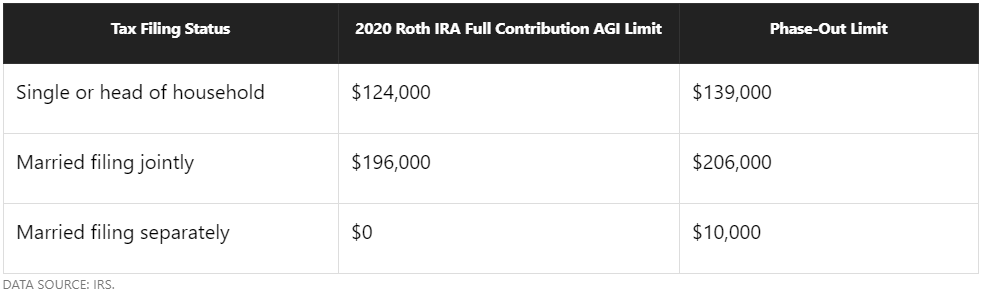

Limits on Roth IRA contributions based on modified AGI.

Can a foreigner open roth ira. Here are the basic rules and qualifications. How Much Can You Put into a Roth IRA. Or you can open an.

That means you cant contribute 6000 to a Roth IRA and 6000 to a traditional IRA in the same year. Answered June 21 2014. Theres the option of a Roth or a traditional IRA.

However you need to consider the income tax laws of the country or countries where you will reside in the future. 29 August 2019 You can open a Roth IRA for anyone who qualifies 1. 2021 - Amount of Roth IRA Contributions You Can Make for 2021.

For 2020 you can invest 6000 in either a traditional IRA or a Roth IRA. As long as they have earned income eg. If you are a US taxpayer you should be able to open an IRA whether your status in the USA is temporary or permanent.

This is a common law form not recognized by all taxing jurisdictions. A Roth IRA can be set up at any point during the year but funds must be contributed by the due date of your return for that year not including extensions. A contribution to a Roth IRA is easy to make and Roth IRA assets will never be taxed if the withdrawals are taken after the owner reaches age 595.

The regular contribution and income limits apply. Foreign Earned Income and Roth IRA Contributions. Dollar for this instead not gold.

A traditional IRA or 401k can result in a lower adjusted gross income AGI because your pretax contributions are deducted from that figure whereas after-tax contributions to a Roth are not. The same combined contribution limit applies to all of your Roth and traditional IRAs. A financial expert explains a shift the wealthy are making with their cashand its potential benefits.

First of all you need to know that as an employed American abroad in most cases you are limited to an ability to contribute only to a traditional or ROTH IRA. This creates a very narrow range of income possibilities for funding a Roth IRA if you live and work abroad. For 2019 and 2020 traditional and Roth IRA rules state Americans may contribute up to 6000 per year or 7000 for Americans over the age of 50.

No Roth IRA contribution is allowed if your MAGI is more than 137000. This can be your sole retirement account. 1 Theres also a limit on who can contribute to a Roth IRA based on your income.

To make a contribution to any type of IRA traditional or Roth you must have un-excluded earned income. Citizen legally working and living in the country can also open an IRA. If an individual is a foreign national that has earned income in the US can they open and contribute to a Roth IRA assuming they fall within the income eligibility limits.

To open a Roth IRA you must have earned income and your income cannot exceed certain limits. If youre 50 or older and need to catch up you can add an extra 1000 for a total of 7000. There is a bit of a.

Your Roth IRA contribution might be limited based on your filing status and income. Sponsored by Stansberry Research. 6500 for those over 50.

Citizens living abroad are the same as they are for citizens living stateside. For Roth IRA purposes a taxpayers AGI is modified to add back any foreign earned income exclusion andor foreign housing exclusion that he may have claimed. A Roth IRA is a vehicle for savings and can be established within the confines of an IRS approved institution credit union bank brokerage house etc.

Three questions regarding foreign nationals and Roth IRAs. Whether or not you can contribute to your regular or Roth IRA while living abroad depends on your foreign income and the exclusions and deductions you claimnamely the foreign earned. If you have a foreign employer you may not have the chance to use a 401 k or SIMPLE IRA option as these are set up within US borders.

Who can open a Roth IRA. For 2020 the maximum contribution to a Roth IRA is 6000 per yearBut if youre 50 or older that increases to 7000 per year. Roth IRAs require your income to be below a certain modified adjusted gross income.

Additionally with his after-tax earnings he makes an annual contribution to a Roth IRA 5500 in 2016 for those under 50. IRA contribution rules for overseas Americans. If you are eligible for the foreign earned income exclusion and qualify to open a Roth IRA your ability to contribute to your Roth may be reduced or eliminated if your MAGI exceeds certain limits.

If your recipient has time to wait before using the funds a Roth IRA can be an enormous gift. 2020 - Amount of Roth IRA Contributions You Can Make for. The IRA distribution rules for US.

Salary from work in the US yes.

When It S A Bad Deal To Inherit A Roth Ira

When It S A Bad Deal To Inherit A Roth Ira

Eligibility For Roth Ira In 2020

Eligibility For Roth Ira In 2020

5 Things To Know About Iras For U S Expats 1040 Abroad

5 Things To Know About Iras For U S Expats 1040 Abroad

Working In The U S Temporarily Here S What You Need To Know About Retirement

Working In The U S Temporarily Here S What You Need To Know About Retirement

What Is A Roth Ira And Do You Really Need One Adopting A Lifestyle Roth Ira Roth Ira Investing Investing

What Is A Roth Ira And Do You Really Need One Adopting A Lifestyle Roth Ira Roth Ira Investing Investing

Understanding Differences Roth Ira Over Traditional Ira

Understanding Differences Roth Ira Over Traditional Ira

You Ask We Answer Ss Dealings Roth Ira Foreign Inheritance More

You Ask We Answer Ss Dealings Roth Ira Foreign Inheritance More

Can And Should An International Student Scholar Or Worker Invest In The Us Personal Finance For Phds

Traditional Or Roth Ira Options Explained

Traditional Or Roth Ira Options Explained

Tax Free Roth Ira Conversion For Expats Thanks To The Feie Online Taxman

Tax Free Roth Ira Conversion For Expats Thanks To The Feie Online Taxman

Can Foreigners Invest In The Us Stock Market Investing Simple

Can Foreigners Invest In The Us Stock Market Investing Simple

How Moving Your Ira Roth Ira Will Affect Your Taxes

How Moving Your Ira Roth Ira Will Affect Your Taxes

Webull Roth Ira Review 2021 Best Roth Ira Investing Simple

Webull Roth Ira Review 2021 Best Roth Ira Investing Simple

The Ultimate Roth Ira Conversion Guide For 2021 Rules Taxes

The Ultimate Roth Ira Conversion Guide For 2021 Rules Taxes

Mega Backdoor Roth Ira The 1 Strategy In 5 Easy Steps 2021

Mega Backdoor Roth Ira The 1 Strategy In 5 Easy Steps 2021

Can A Foreigner Have A 401k And Roth Ira Accounts In The Usa Quora

Can A Foreigner Have A 401k And Roth Ira Accounts In The Usa Quora

/GettyImages-117455432-f5313bc7539b43ec8f78e11c71f3e430.jpg) How Foreigners Can Open Savings Accounts In The U S

How Foreigners Can Open Savings Accounts In The U S

Can Non Residents Open A Roth Ira Account Vanguard Told Me That I Am Mot Eligible To Open One Any F1 Or H1b Folks Here That Were Able To Open One Fishbowl

Can Non Residents Open A Roth Ira Account Vanguard Told Me That I Am Mot Eligible To Open One Any F1 Or H1b Folks Here That Were Able To Open One Fishbowl

Post a Comment for "Can A Foreigner Open Roth Ira"